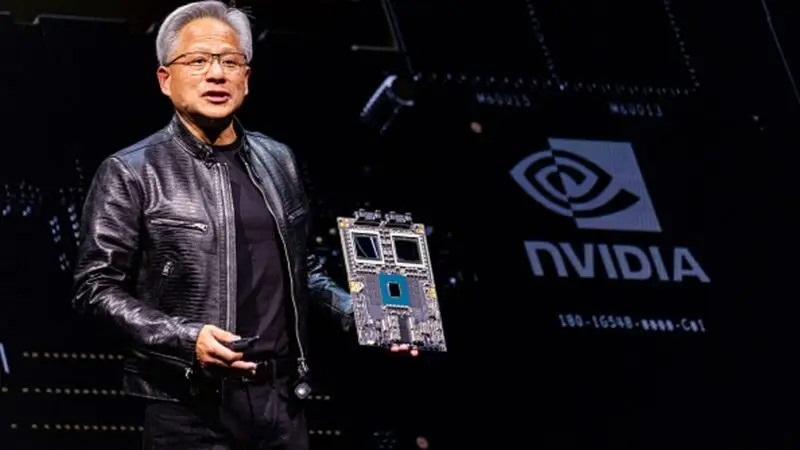

One of the biggest winners on Wall Street this year, Nvidia (NVDA), has gotten a price target increase from Citi as the chipmaker’s earnings report nears. The company with a market cap of more than $3.6 trillion is looking to end the year on a high note. Considering the heights it reached in 2024, that certainly is a tall task.

Yet, it is one that many analysts are expecting, as the company’s additional Blackwell sales on its January data center figures have recently been factored into advisory models. With many experts holding a buy rating, there are high hopes for its performance after the earnings report arrives. Moreover, it is expected to set the tone for what should be an impressive stretch when the calendar turns to 2025.

Also Read: Nvidia to Surge to $180? Why Wall Street is Expecting a Big Boost

Citi Gives Nvidia Target Boost Amid Earnings as Quest to $4 Trillion Continues

For the last two years, AI technology has seemingly dominated Wall Street. With the arrival of OpenAI’s ChatGPT, consumer demand has skyrocketed. To answer that demand, a plethora of companies has sought to increase spending in what has become an AI arms race.

Although firms like Microsoft (MSFT), Amazon (AMZN), and Alphabet (GOOGL) have made progress, none can compete with Nvidia. Indeed, the AI chipmaker is currently on pace to be the first company to reach a $4 trillion market cap. Therefore, it could surpass Apple (APPL), the company to set the $2 trillion and $3 trillion market cap records.

There has been a concern that the momentum could begin to wear off for the sector and its biggest performers. However, that fear is quelled by record earnings. That should only continue this month, as Nvidia (NVDA) has seen its price target get a boost from Citi amid a $4 billion addition to its upcoming earnings report.

Also Read: Can Nvidia (NVDA) Target $200 Before 2025?

New updates to advisory models have the company’s burgeoning data center business factoring in revenue of $3 billion to $4 billion. Therefore, Citi responded by increasing the NVDA price target from $150 to $170. That brings the company’s shares ever closer to the $200 mark.

The question is: will this pace be deterred any time soon? Analysts have predicted continued growth over the next five years. Although it may not remain atop the market cap list as it is currently, it should continue to grow.

The company dominates 95% of the AI graphics processing units (GPU) market share, Citi reports. With the company already having a headstart over the completion, that placement should not be threatened. Barring any unforeseen circumstances, it should be well on its way to $5 trillion.