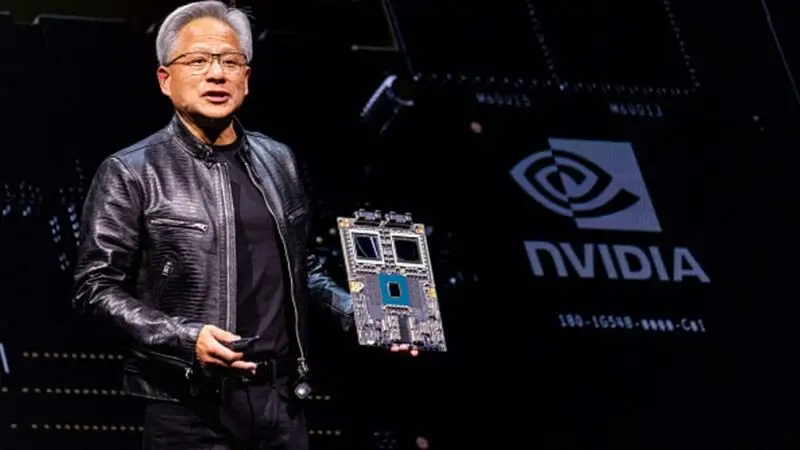

There are few stocks that have had as good a year as Nvidia has had. The chipmaker has been a clear beneficiary of the stock market’s AI boom. Yet, that interest does not appear to be waning, as the company continues to be growing in value. As it looks to target the $4 trillion mark in the coming year, can Nvidia (NVDA) reach a stock price of $200 before the calendar turns to 2025?

The prospect is certainly a difficult one to imagine. In order for NVDA to reach that mark before the year ends, it would need to increase more than 32% from its current position in just two months. However, nothing seems impossible for the company that has recorded 175% growth over the last 12.

Also Read: Nvidia: NVDA Looks to Acquire AI Startup Amid Race to $4 Trillion

Can Nvidia Target $200 Before January? Why NVDA Shouldn’t Be Counted Out

Since the arrival of OpenAI’s ChatGPT program, AI has been all the rage. Specifically on Wall Street, information technology stocks that have shown an aptitude and interest in the sector have benefitted. Although that may be slowing down, the firms at the top are still thriving. Chief among them is Nvidia.

The company is currently seeking to be the first to reach a $4 trillion market cap. In order to do that, it has to outperform Apple (APPL), the first company to reach both $2 trillion and $3 trillion in market value. But that pursuit seems logical, which leaves many to believe that NVDA’s stock price is certain to far surpass its current stance.

But can Nvidia (NVDA) surpass the $200 level before 2025? That becomes a little bit more difficult. Yet, it is far from impossible, given its growth trajectory and positive sentiment. In a recent analysis shared on TradingView, experts noted the stock had bounced back from a strategic buying opportunity in early August.

Also Read: Billionaire Paul Tudor Jones Dumps Palantir, Goes All-In on Nvidia (NVDA)

Additionally, they described that the chipmaker stock should be able to hold onto bullish momentum if it can hold support at the 200-day moving average. Altogether, that led the analysts to give the stock a short-term target of $190.

Additionally, they project it to surge above the $240 level in early 2025. Similarly, Peter DiCarlo recently noted that Nvidia was preparing to break out. In an October 30th post, he assured that NVDA was close to confirming a rally to $150.

Those two projections place a potential chance for the $200 level to be breached before January but is still likely improbable. The stock is most likely to surge around $170-$180 by the time the year ends.