Bitcoin has hit a significant turning point in institutional acceptance. According to Mike Novogratz, who heads Galaxy Digital Holdings, nations are now buying large amounts of cryptocurrency. He reports that countries’ stockpiling of BTC continues steadily even as crypto market volatility remains constant.

Also Read: What Nvidia’s Q3 Stock Drop Means for AI and Tech Investors

Novogratz Reveals Countries Buying Bitcoin in Huge Volumes: What It Means

Unprecedented Middle Eastern Bitcoin Adoption

A trusted contact who first showed Novogratz cryptocurrency in 2013 reports exceptional and growing interest from Middle East investors. “He’s never seen anything like it. He’s convincing more people to buy Bitcoin in the three days he’s been there than any time in his whole career, and they’re huge pools of capital. And so we’re seeing something globally,” Novogratz said on Bloomberg TV.

Global Leaders React to Trump’s Crypto Stance

Former President Trump’s clear promise to be a “crypto president” and “Bitcoin president” has caught other world leaders’ attention. This strong push for cryptocurrency adoption has led more countries to consider investing in digital assets seriously.

Also Read: MicroStrategy (MSTR) Stock: Can It Claim $570 Amid Bitcoin Boom?

Strategic Reserve Considerations

On the topic of a U.S. Strategic Bitcoin Reserve, Novogratz stayed realistic but optimistic. “It would be very smart for the United States to take the Bitcoin they have and maybe add some to it,” he said. This decisive move would show America leads in technology and digital assets development.

Legislative Hurdles and Timeline

Countries stockpiling BTC face significant legal and regulatory obstacles. Without a Strategic Reserve, Novogratz thinks major price gains could take “six, seven, eight years.” He warned that rushing into buying during high crypto market volatility might signal deeper economic problems.

Also Read: 3 Commodities To Invest in 2025 For Top Returns

Generational Wealth Shift

Gold currently holds $16 trillion in market value. But Novogratz sees a clear and definitive age divide in investing preferences. “Forty-year-olds own no gold. Thirty-year-olds own none,” he said. Young investors consistently prefer cryptocurrency adoption despite ongoing market risks.

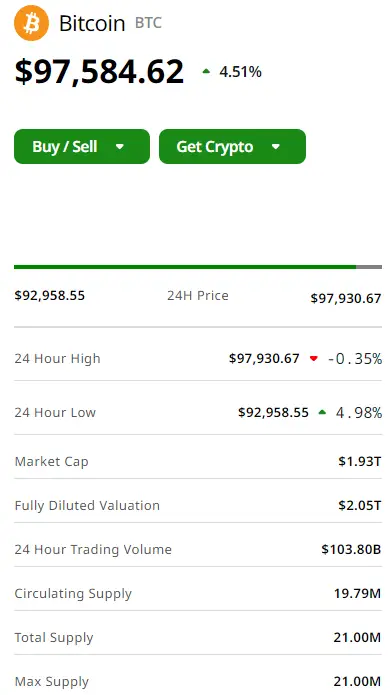

BTC now trades at $97,000, showing growing trust and confidence from government buyers worldwide.