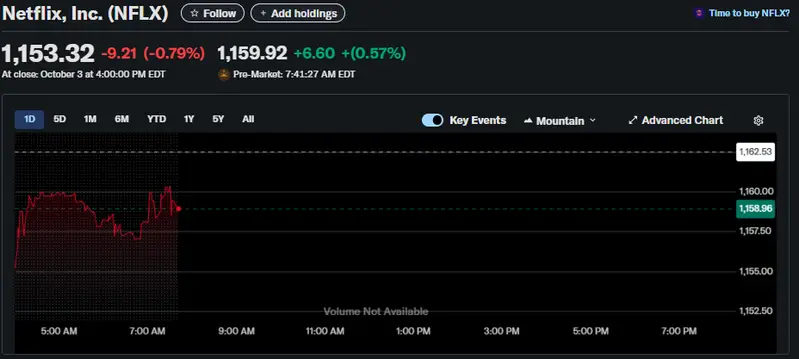

The Netflix stock drop hit hard on October 6th, 2025, and shares plunged 9% again while erasing $25 billion in market value. This happened right after Elon Musk’s viral boycott call gained momentum. The streaming platform’s stock closed at $1,153.32, and this also marks another severe decline following an initial 5% drop on October 3rd. We could say that boycotts work now, right?

This decline in Netflix stocks is in fact the most dismal weekly performance by this company since April 2025. The Elon Musk Netflix boycott has gained serious traction across social media platforms and even triggered mass subscription cancellations among users.

Elon Musk’s Netflix Boycott Sparks 9% Stock Drop and $25B Market Cap Loss

The Elon Musk Netflix controversy started on October 1st when Musk posted on X. He stated:

“Cancel Netflix for the health of your kids.”

The post went viral immediately and racked up over 51 million views. Right now, the financial impact of that single post is being felt across markets.

Financial Impact and Market Response

As a matter of fact, NFLX market cap loss only reached around 17 billion following the early October 3rd fall. Another 9% decline wiped out another $25 billion value by October 6th, and it has been a heavy blow to investors to this Netflix stock drop.

Pre-market trading on October 7th showed shares at $1,159.92, up $6.60. This indicates some recovery, but also continued volatility following the Elon Musk Netflix boycott campaign.

Also Read: October Stock Market Crash: Could Markets Face a Sharp Sell-Off?

Subscriber Impact and What’s Next

The decline of Netflix subscribers is coming true as it is already announced that thousands of subscribers canceled their subscriptions. This Netflix stock drop has undermined the susceptibility of the platform to influencer campaigns. The impact may be enormous and given the fact that Musk has over 200 million followers, it may be decisive.

The Elon Musk Netflix scandal has brought up the issue of content choices and their implications on the business. The NFLX market cap loss and continuing reduction of Netflix subscribers will be observed keenly in the following earnings reports at the time of writing.

Also Read: Stock Market Government Shutdown Sparks Panic Over CPI, Jobs Report

Investors are attempting to ask themselves whether the decline in this Netflix stock is a short-run issue or even a long-term issue of the streaming company.