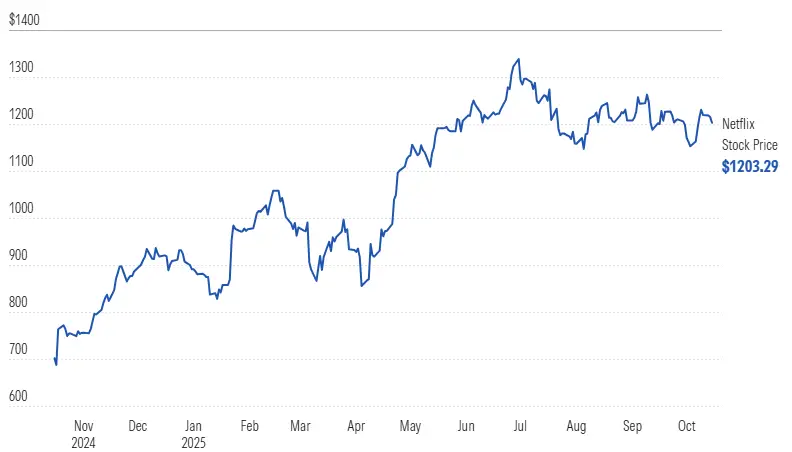

Netflix stock took a hit after the streaming giant reported third-quarter 2025 earnings that came in below expectations, and the shortfall was tied to an unexpected tax dispute in Brazil. NFLX stock traded at $1,203.29 as investors tried to figure out what this means for future profitability and how the company plans to navigate regulatory challenges in one of its most important international markets right now.

Also Read: AMD Stock Gets Forecast Hike From Bank of America, Cites 11/11

Netflix Earnings 2025 Outlook and Stock Forecast After Q3 Miss

The tax issue in Brazil forced Netflix to revise its full-year operating margin forecast downward from 30% to 29%, which caught a lot of investors off guard. Across multiple essential regulatory frameworks, Netflix stock faces pressure as analysts assess whether this development represents an isolated incident or signals broader headwinds.

At the time of writing, the company reported third-quarter revenue of $11.75 billion, marking a 15.2% increase from the same period last year, and such growth came in slightly below what analysts had anticipated. The Brazil tax matter has spearheaded various major concerns about Netflix’s international operations and profitability trajectory. For the full year, the company is still projecting $45.1 billion in revenue, which represents a 16% jump from 2024 and aligns with earlier expectations.

Price shown in USD

Subscriber Growth Remains Strong Despite Headwinds

NFLX stock got some support from solid subscriber numbers, as Netflix added 5.1 million net new subscribers during the quarter. Through several key market segments, this growth brought the company’s global membership total to 285 million, and expansion was particularly strong in the Asia-Pacific region where Netflix continues to invest heavily in local content production and partnerships. Such strategic initiatives have accelerated various major opportunities for subscriber acquisition across numerous significant international markets.

Advertising Business Shows Momentum

Despite the earnings miss, Netflix delivered some encouraging news on the advertising front, and Co-CEO Greg Peters noted that the company posted its best ad sales quarter ever during the period. Across multiple essential revenue streams, NFLX stock investors are watching closely to see if advertising can become a meaningful revenue driver going forward, also considering the broader implications for the company’s business model transformation.

Ross Benes, senior analyst at EMarketer stated:

“Netflix had its best ad sales quarter to date, but still did not provide a figure for how large the ad business is. This gives the impression that the sustained revenue growth achieved this quarter, and forecasted for next quarter, will predominantly continue to come from subscription fees.”

The company raised prices in January 2025, including the cost of its ad-supported tier, and those increases are now flowing through to the revenue line. Through various major pricing strategies, such power demonstrates Netflix’s strong brand position, even as competition in the streaming space continues to heat up and reshape certain critical market dynamics.

Wall Street weighs in On Netflix Stock Forecast

Analysts remain divided on the Netflix stock price outlook following the Q3 report, and Morningstar maintains a 1-star rating with a fair value estimate of $750 per share. Across several key valuation metrics, this assessment suggests the stock is trading well above what fundamentals support right now.

Morningstar analyst Matthew Dolgin, CFA had this to say:

“Despite the stock’s price decline over the past quarter, we still see Netflix as significantly overvalued. It’s a best-in-breed company, but we don’t think its outlook for sales or profit growth justify its extraordinarily lofty multiples.”

The firm’s concerns center on Netflix’s ability to sustain its recent sales growth trajectory, particularly as the U.S. market shows signs of maturation. Through numerous significant market developments, the company will soon lap its most recent price increase and face various major challenges in maintaining momentum.

Content Pipeline Aims to Drive Engagement

The fourth quarter will also rely on the content strategy that the Netflix company implements to determine the stock price. Some of the most hyped projects planned in the future would help maintain the subscriber base, including the fifth and final season of Stranger Things, new seasons of The Diplomat and Nobody Wants This, and an adaptation of Frankenstein by Guillermo del Toro.

Netflix is also ridding on the great success of the “KPop Demon Hunters,” which had become the most-viewed movie at the platform with over 325 million views. The company has also revealed that they have collaborated with Hasbro and Mattel to increase the reach of the film with merchandises that will be available on retail shelves in spring of 2026.

What’s Next for Netflix Stock

Investors who will be keen on the Netflix earnings 2025 trend will be keen on how the company will overcome the international regulatory hurdles and still remain on its growth path. The Brazil tax controversy is a wake-up call that a global streaming company should expect difficulties that could affect profitability in an unanticipated manner.

Also Read: Palantir Set to Surpass Oracle by 2030 With Explosive AI Growth

At this point, the Netflix stock outlook in the next sets of quarters will depend on several aspects: are there any new tax or regulatory challenges in other major markets, can the company still continue growing its advertising revenues to balance the slow subscription growth in the established markets, and will new content be more effective in engaging and reducing the churn rates.

The new operating margin outlook of 29 per cent in the entire year indicates the financial liability of the tax issue but also indicates that Netflix is controlling its expenditures despite these headwinds. The Netflix stock value will be monitored by investors as the company goes through the rough times and tries to conquer the position of the leading streaming service worldwide.