Netflix stock turned $1,000 into $380,729 in 20 years. Here’s how this massive profit was possible.

Let’s explore this topic and find out why you don’t have $380.000 in your account right now!

Also Read: Top 3 Meme Cryptocurrencies That Could Double Your Investment

How Netflix Stock Became a Millionaire Maker: Investment Insights

The Right Timing

Buying Netflix stock in 2004 was key. Back then, shares cost about $10 each. $1,000 bought 100 shares. This timing was crucial for the big profit.

Also Read: [The Importance of Entry Point in Stock Investing]

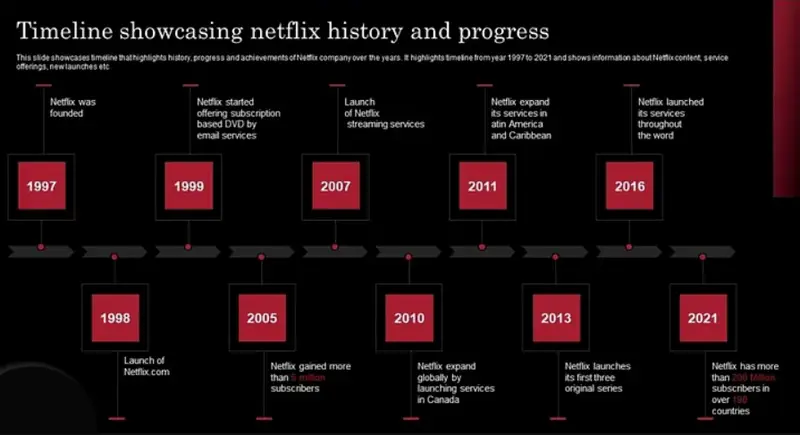

Netflix’s Smart Moves

Netflix made three big changes that boosted its stock. It started streaming movies online. Then it made its own shows. Finally, it expanded to other countries. These moves drove the stock price up.

Reed Hastings, the Co-founder and Chairman, had this to say:

“Most entrepreneurial ideas will sound crazy, stupid and uneconomic, and then they’ll turn out to be right”

Netflix Stock Holding Through Ups and Downs

To get the $380,000 profit, you had to keep the stock for 20 years. This meant not selling during market drops. Holding through tough times was essential for the big gain.

Also Read: [How to Stay Calm During Market Volatility]

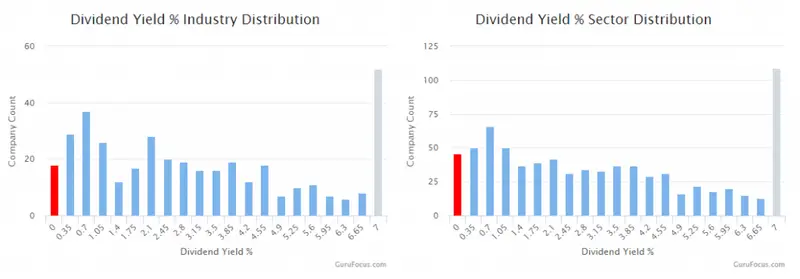

Reinvesting Dividends

Netflix doesn’t pay dividends. This helped the stock grow more. The company used its money to grow instead of paying shareholders. This strategy increased the stock’s value over time.

Luck Played a Part

Some luck was involved too. Netflix beat its competitors and grew faster than anyone expected. This kind of success is rare and hard to predict.

Also Read: [Balancing Skill and Luck in Stock Picking]

To get a $380,000 profit from Netflix stock, you needed to buy early, hold for years, and pick a company that grew exceptionally well. While this level of return is uncommon, understanding how it happened can help in finding future opportunities.