According to a press release, CEA Industries has announced the purchase of 38,888 BNB coins. The coins are worth around $33 million. The company now holds a total of 388,888 BNB tokens, valued at $330 million, making CEA Industries the world’s largest corporate BNB treasury. The company aims to buy 1% of the total BNB supply by the end of 2025. Despite the big purchase, Binance’s BNB coin continues to face a price dip.

Will Binance Coin Recover?

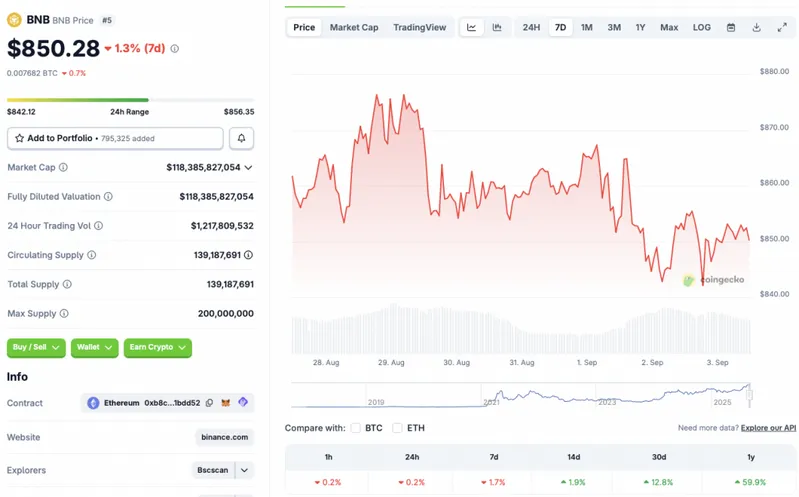

Binance’s BNB coin has faced a 0.2% correction in the daily charts and a 1.7% correction in the weekly charts, according to CoinGecko’s BNB statistics. Despite the dip, the asset has maintained gains in the other time frames, rallying 1.9% in the 14-day charts, 12.8% in the monthly charts, and nearly 60% since September 2024.

BNB currently faces some resistance at the $850 mark. The asset recently climbed to an all-time high of $899 on Aug. 22. BNB’s price has fallen by 5.5% since its August peak. Given the bullish outlook from CEA Industries, BNB’s price may continue to surge as the firm consistently makes more BNB purchases.

BNB’s latest price dip could be due to the general bearishness in the market. Bitcoin (BTC) recovered the $110,000 price point after falling below $108,000. BTC’s price seems to be consolidating around the $110,000 mark.

September has historically been among the worst months for the crypto market. We may be following a similar pattern in 2025. Investors may be taking caution in the anticipation of a bearish month. Moreover, macroeconomic constraints and global trade wars may present challenges to BNB and the larger market.

Also Read: BNB Price: $1000 Incoming? Traders Should Not Ignore This Forecast

However, the Federal Reserve is expected to cut interest rates by 25 basis points after its next meeting. A rate cut could lead to the market rebounding. BNB’s price could recover under such a development.