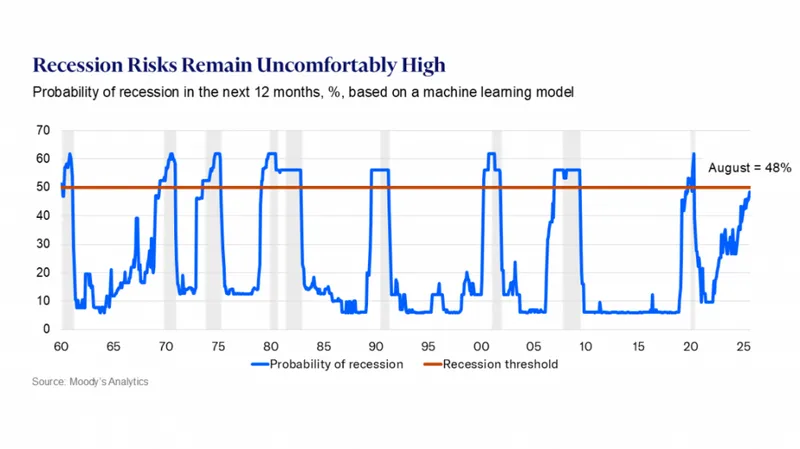

US recession probability in 2025 has reached some pretty alarming levels right now, and Moody‘s recession forecast is indicating a 48% chance of an economic downturn within the next 12 months. Mark Zandi’s recession odds show this represents the highest probability ever recorded without an actual recession occurring, raising serious concerns about US economy recession risk.

There is an uncomfortably high 48% probability that the U.S. economy will suffer a recession in the next 12 months. That’s according to Moody’s recently unveiled leading economic indicator, derived using a machine learning algorithm on our extensive databases. It’s less than 50%,… pic.twitter.com/AGuEJznDzQ

— Mark Zandi (@Markzandi) September 14, 2025

Understanding Moody’s 48% Recession Probability: Key Indicators and Implications

The 12-month recession outlook actually stems from Moody’s machine learning algorithm, which has been analyzing some extensive economic databases. At the time of me writing this information, Mark Zandi has stated that:

”There is an uncomfortably high 48% probability that the U.S. economy will suffer a recession in the next 12 months. That’s according to Moody’s recently unveiled leading economic indicator, derived using a machine learning algorithm on our extensive databases.”

Historical Context of US Recession Probability 2025

This particular Moody’s recession forecast represents unprecedented territory, and it’s been getting attention from economists everywhere. Mark Zandi explained the significance:

”It’s less than 50%, but historically, the probability has never gotten this high, and a recession has not ensued.”

The US economy recession risk calculation incorporates multiple economic indicators, which makes this 12-month recession outlook particularly concerning for policymakers along with investors alike. Right now, the data is being closely monitored by financial institutions.

Also Read: 9 Recessions, 50 Years: Wall Street Icon Predicts 2025 Market Crash

Market Implications of Current Mark Zandi Recession Odds

In fact, financial markets are reacting to the probability of a US recession in 2025 with greater volatility that has been felt throughout the various sectors. The 48 percent in the recession projection by Moody has led institutional investors to do defensive moves, especially considering the way the US economy recession risks factors are converging all at the same time.

This 12-month recession prognosis is showing conservatism in corporate decision making and businesses are delaying large investments and adopting conservative hiring policies. These projections are even hitting some of the biggest companies.

Recent Mark Zandi recession probabilities indicate that the state of the economy is at a crossroad where any slight fluctuation would heavily impact the chances of the US recession 2025 happening, or, in fact, it can start slipping downwards in the next few months.

Also Read: New Indicator Suggests a Recession Is Likely To Come in 2 Months