The US stock market has had a less-than-ideal start to the year so far. There is no shortage of reasons why investors have proven to be concerned with the economic reality. However, with things expected to turn around soon, Microsoft (MSFT) has gotten a $550 target with Wall Street betting big on the tech stock.

The company has been one of the most promising shares to buy in recent years. There are few who have been as good at diversifying their businesses to maximize their presence in the tech sector. Moreover, experts are showing why it may end up being the best of the mega-cap stocks.

Also Read: Microsoft (MSFT) Called ‘AI Leader’ by Scotiabank Amid $470 Target

Microsoft Gets Upped Price Target as Wall Street is Betting Big On The Stock

The technology sector was a big draw throughout the last few months of 2024. Yet that seemed to flip on its head at the start of this year. Companies like Tesla (TSLA) and Nvidia (NVDA) have struggled mightily to gain any kind of momentum throughout the increasingly volatile year.

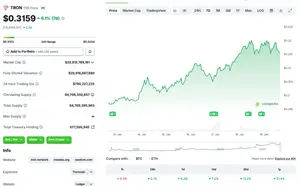

However, that may have created a perfect entry point for one mega-cap stock. Indeed, Microsoft (MSFT) has gotten a new $550 target as Wall Street looks to be ready to bet big on the company. So, here’s why some experts view its current valuation as increasingly attractive.

Also Read: Microsoft (MSFT) Key Part of New $2.7B Data Center Investment

According to a new report, analysts Jefferies, Brent, Thrill have upped their Microsoft stock with the aforementioned $550 target. Moreover, they have given the shares a buy rating, with their projections showcasing a 40% upside for the stock. Although it is down more than 11% over the last three months, there may not be a more enticing entry point.

The analyst notes that the company is looking to enjoy “steady or improving growth” for both its Microsoft 365 and Azure businesses. Those boast solid fundamentals and makeup 53% of its entire company. Moreover, they expect increased profit margins from its ongoing AI investments.

There have been concerns about the company’s capital expenditures. To this point, it has already invested more than $80 billion into AI plans for this year alone. However, many experts expect that to go from being a concerning thing to a beneficial factor. Thus, the company is expected to surge well above the $500 mark before the year is through.