Metaplanet buys Bitcoin in another major acquisition, and this time they’ve purchased 1,111 BTC worth $111 million to boost their corporate treasury. This strategic move also strengthens Japan Bitcoin investment trends and demonstrates growing BTC institutional adoption as corporate BTC holdings expand globally right now. The purchase brings Metaplanet’s total Bitcoin holdings to 11,111 BTC valued at $1.11 billion, with Bitcoin price prediction 2025 suggesting potential targets of $117,000.

JUST IN: Metaplanet buys another 1,111 Bitcoin worth $111 million.

— Watcher.Guru (@WatcherGuru) June 23, 2025

They now hold 11,111 $BTC worth $1.11 billion. pic.twitter.com/j9TGy3K4xq

Also Read: Bitcoin’s Competition Is Not Gold Or USD, But This: Bitwise CEO

Japan Bitcoin Investment Grows As Corporate BTC Holdings Soar

The latest announcement shows Metaplanet buys Bitcoin at an average price of 15,535,502 yen per Bitcoin, and the total purchase amount reached 17.260 billion yen. This acquisition also reinforces Japan Bitcoin investment leadership and highlights how BTC institutional adoption continues accelerating across Asian markets at the time of writing.

Strategic Treasury Operations Expand Bitcoin Holdings

*Metaplanet Acquires Additional 1,111 $BTC, Total Holdings Reach 11,111 BTC* pic.twitter.com/7ceEeSh1X4

— Metaplanet Inc. (@Metaplanet_JP) June 23, 2025

Metaplanet’s Bitcoin treasury strategy demonstrates calculated corporate BTC holdings management, and their total Bitcoin position now stands at 11,111 BTC. The company’s average purchase price across all acquisitions is 14,077,243 yen per Bitcoin, representing an aggregate investment of 156.412 billion yen in digital assets.

The timing also aligns with growing Bitcoin price prediction 2025 optimism, as institutional investors position themselves for potential market expansion right now. This purchase pattern shows how Metaplanet buys Bitcoin systematically rather than through sporadic acquisitions.

Also Read: Glassnode: 216 Entities Control 30% Bitcoin, Can 25x Market With $1

Performance Metrics Show Strong Returns

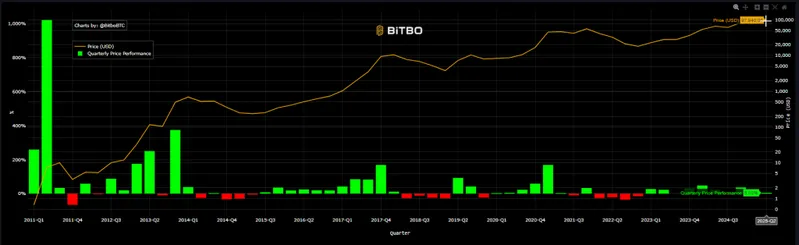

The company’s BTC Yield performance demonstrates successful Japan Bitcoin investment execution across multiple quarters. From July 1, 2024 to September 30, 2024, their BTC Yield reached 41.7%, and October 1, 2024 to December 31, 2024 showed exceptional performance at 309.8%.

Recent quarters also maintain strong momentum, with January 1, 2025 to March 31, 2025 achieving 35.6% BTC Yield. The current quarter from April 1, 2025 to June 23, 2025 shows an impressive 107.0% performance, supporting bullish Bitcoin price prediction 2025 scenarios.

Market Impact and Future Outlook

This acquisition pattern reflects broader BTC institutional adoption trends, and corporate BTC holdings are becoming standard treasury management practice. As more companies recognize Bitcoin’s value proposition, Japan Bitcoin investment continues setting regional benchmarks for cryptocurrency integration at the time of writing.

The systematic approach shows how Metaplanet buys Bitcoin as part of long-term strategic planning rather than speculative trading. This methodology also supports market stability while positioning the company for potential Bitcoin price prediction 2025 upside scenarios targeting $117K levels right now.