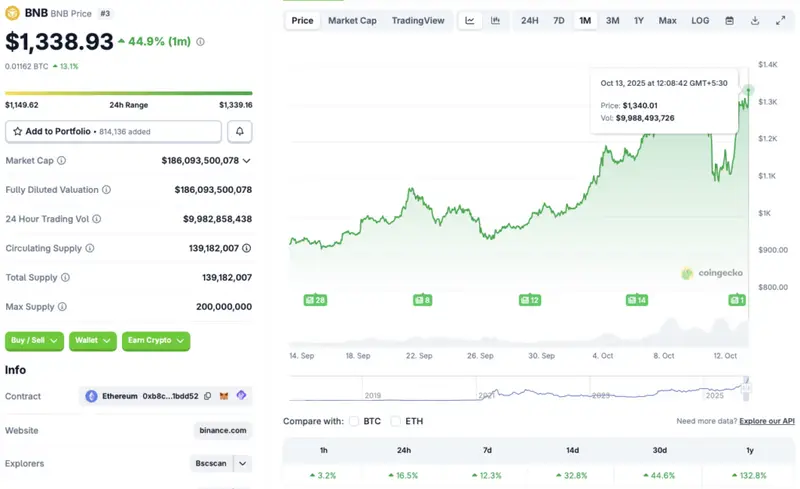

The cryptocurrency market seems to be quickly recovering from the recent crash. Binance’s BNB token is currently one of the hottest crypto assets in the market. The ongoing market recovery has pushed BNB to a new all-time high of $1340. According to CoinGecko data, BNB is up 16.5% in the daily charts, 12.3% in the weekly charts, 32.8% in the 14-day charts, and 44.6% over the previous month. BNB is currently outperforming major crypto assets, such as Bitcoin (BTC), Ethereum (ETH), XRP, etc.

What’s Pushing BNB To New All-Time Highs?

Binance’s BNB coin has been experiencing a bullish phase over the last few weeks. The crypto market saw increased inflows after the US government shut down earlier this month. However, the rally came to a halt after tensions between the US and China flared up. President Trump announced 100% tariffs on China from November as a response to China’s limiting rare earth material exports.

BNB’s rally could also be due to massive burns earlier this year. Binance undertook a $1 billion token burn in July through the BNB Foundation. The move led to a substantial dip in the coin’s supply, and, consequently, a price spike.

BNB’s upswing could also be due to increased corporate buying. Corporate treasuries have seen a massive rise in popularity over the last year. Corporate buys have played a major role in the market rallies this year.

Also Read: BNB Flips XRP To Become the Third Largest Cryptocurrency

On-chain metrics for Binance’s BNB have also seen a bullish reversal over the last month. DefiLlama data shows the total value locked (TVL) on the BSC chain has risen 9.89% in the last 24 hours, hitting the $9 billion mark.

BNB will likely continue its rally over the coming days. The Federal Reserve is expected to roll out another interest rate cut after its next meeting. Another rate cut could trigger a market-wide upswing. BNB could breach the $15000 mark under such circumstances.