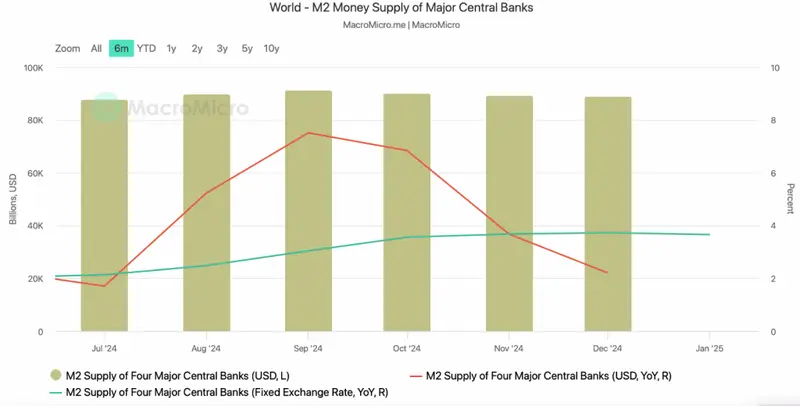

M2 money supply growth has captured the attention of cryptocurrency analysts. They see strong correlations between expanding global liquidity and Bitcoin price rally potential. Recent data indicates the year-on-year fixed exchange rate for the M2 money supply of the four major central banks reached 3.65% in January. This signals some possible favorable conditions for cryptocurrency market volatility.

Also Read: Ethereum Buyers Pile In as Aya Miyaguchi Takes Over—Will ETH Rebound?

How M2 Money Supply Impacts Bitcoin Prices and Market Volatility

The relationship between monetary policy and cryptocurrency performance has been closely studied by market experts. Historical data suggests Bitcoin follows global M2 money supply trends with remarkable consistency.

Analysts Point to Historical Correlations

Several cryptocurrency analysts have highlighted the statistical relationship between M2 supply growth and Bitcoin performance. According to economist Lyn Alden, Bitcoin moves in the direction of global M2, 83% of the time. This was noted in her September research report.

“In normal times, global loosening measures are a pretty reliable lead indicator for crypto,” Pav Hundal, lead analyst at Australian crypto exchange Swyftx, told Cointelegraph. “The data we have suggests that spot buyers are active right now, and the US has raised its debt ceiling by $4 trillion dollars.”

Current M2 Trends and Market Implications

Global M2 (shifted forward by 30 days) vs Bitcoin

— bitcoindata21 (@bitcoindata21) February 25, 2025

With weakness in the dollar causing a net positive effect on Global M2, just a matter of time hopefully before Bitcoin realises. pic.twitter.com/saO7xRpsYP

The expansion of global M2 money supply has been watched closely by investors seeking to understand potential market movements. Recent weakness in the US dollar has been identified as contributing to positive effects on Global M2 statistics.

“With weakness in the dollar causing a net positive effect on Global M2, just a matter of time hopefully before Bitcoin realizes,” stated crypto analyst bitcoindata21 in a February social media post.

Also Read: Bitcoin Crash: How High Can BTC Surge In 2025 Now?

US Money Supply Doubling Creates Potential Catalyst

The US money supply has doubled in just 10 years

— Bravos Research (@bravosresearch) February 24, 2025

This liquidity surge could fuel Bitcoin’s parabolic run-up

If Bitcoin reached gold’s market cap, it would hit $1 million

Is this really possible?

A thread 🧵 pic.twitter.com/hEACXMJ1Vz

The United States money supply has experienced significant expansion in recent years. This development has been highlighted by market researchers as a potential trigger for cryptocurrency appreciation.

Investment research account Bravos Research pointed out that “the US money supply has doubled in just 10 years,” adding that “this liquidity surge could fuel Bitcoin’s parabolic run-up.”

Expert Caution Amid Optimism

Despite positive indicators, some analysts advise measured expectations. “This isn’t a market to bet your whole stash on a quick correction, but our central scenario is still for a strong March and beyond,” Hundal cautioned.

Crypto analyst Colin Talks Crypto echoed this sentiment. He stated that “the Global M2 Money Supply predicts a BIG MOVE is coming for Bitcoin” while acknowledging the inherent uncertainties in market timing.

The Global M2 Money Supply predicts a BIG MOVE is coming for BITCOIN pic.twitter.com/AZTaARU7pp

— Colin Talks Crypto 🪙 (@ColinTCrypto) February 15, 2025

Also Read: Ripple XRP Predicted To Hit $4.20: Here’s When

Bitcoin’s price recently showed some of its typical volatility. It fell below $90,000 in late February after Trump’s tariff comments, showing how factors outside monetary policy affect short-term prices.

Investors are watching as the growing global M2 money supply is growing. They see it as a key indicator to predict Bitcoin’s price movement amid market uncertainty.