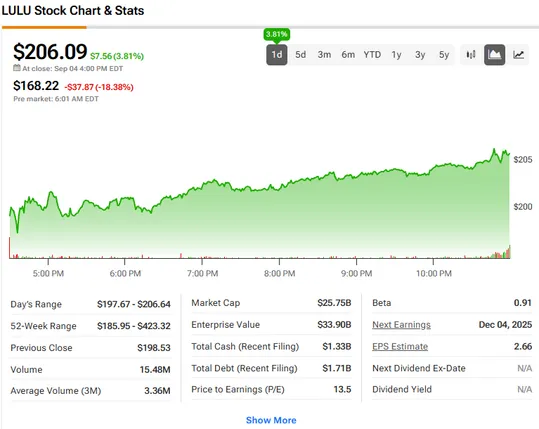

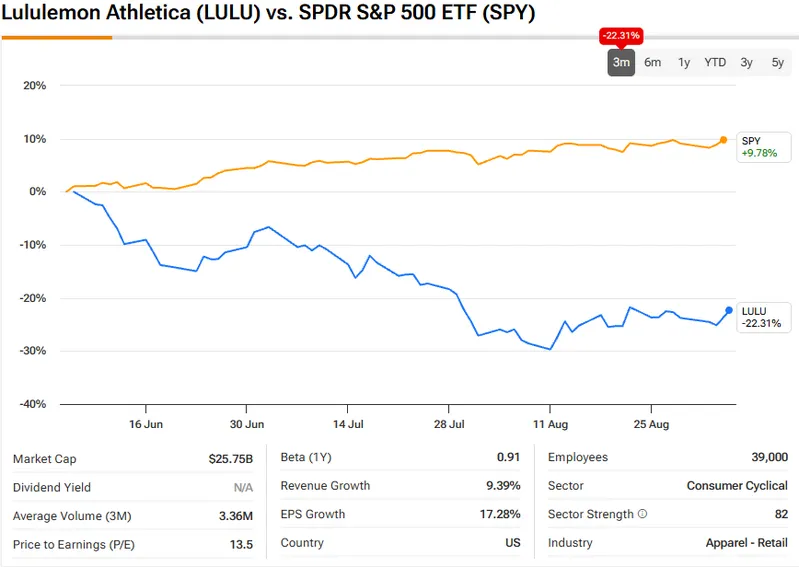

LULU stock actually gained some momentum following recent earnings results, and analysts are maintaining strong price targets despite mixed quarterly performance. The LULU stock price showed volatility as investors processed Lululemon earnings data along with updated guidance from management right now.

LULU Stock Price Forecast: Lululemon Earnings, Analyst Ratings, And Gains

Mixed Earnings Results Impact LULU Stock

Lululemon earnings for Q2 2025 actually delivered a beat on earnings per share at $3.10 versus $2.88 expected, but revenue of $2.53 billion fell slightly short of the $2.54 billion estimate. The LULU stock price initially dropped over 12% after hours as investors focused on weaker guidance and U.S. market challenges that were presented by the company.

Calvin McDonald, CEO, had this to say:

“We are not satisfied with the results for the quarter, and we know our brand can and will perform better than these results.”

At the time of writing, the stock has been recovering some of those losses, and investors are weighing the earnings beat against future concerns.

Analyst Targets Support LULU Stock Forecast

Despite recent challenges, Wall Street maintains optimistic views on the stock forecast right now. Based on 24 analyst ratings, LULU stock holds a “Moderate Buy” rating with 12 buy recommendations versus 11 hold and 1 sell rating. The average price target of $267.76 represents significant upside potential, while the highest forecast reaches $375.00, which is pretty impressive even considering current headwinds.

Also Read: Tesla, Amazon, Apple, Alphabet Stocks Fall as NASDAQ Sheds 150 Points

Guidance Cuts Reflect Industry Headwinds

Management reduced full-year earnings expectations to $12.77-$12.97 per share, well below Wall Street’s $14.45 estimate. Third-quarter revenue projections of $2.47-$2.50 billion also came in below the $2.57 billion consensus, and this has been weighing on investor sentiment.

McDonald stated:

“We are facing yet another shift today within the industry related to tariffs and the cost of doing business. The increased rates and removal of the de minimis provisions have played a large part in our guidance reduction for the year.”

The CEO also addressed product strategy concerns:

“We have become too predictable within our casual offerings and missed opportunities to create new trends. Our lounge and social product offerings have become stale and have not been resonating with guests.”

Also Read: China Stocks Surge to Decade-High Amid Market Optimism

Despite near-term headwinds affecting the stock price, the strong analyst support with targets reaching $375 suggests confidence in Lululemon’s long-term prospects. International growth, particularly in China with 22% constant currency gains, provides optimism for the LULU stock forecast moving forward, even as domestic challenges persist.