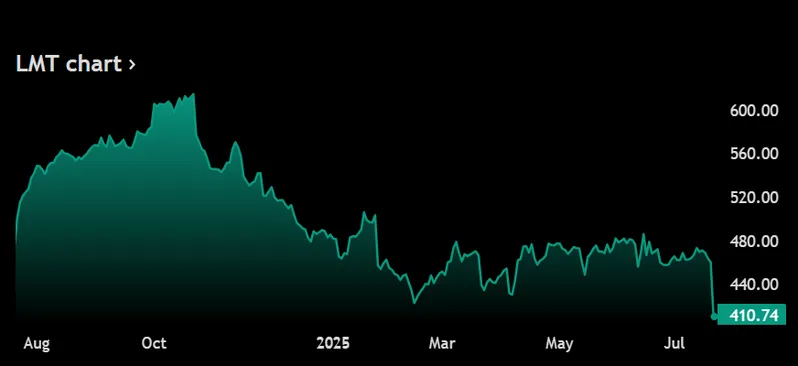

Lockheed Martin’s Q3 earnings, as TradingView reveals, actually took a pretty significant hit, dropping 36% to $1.6 billion even though the company managed to pull in $17.1 billion in quarterly sales. The defense contractor’s Lockheed Martin Q3 earnings decline was driven by program losses and also increased operating expenses, which has raised some concerns about defense stock performance and what we might see for Lockheed Martin revenue 2025 projections going forward.

Jim Taiclet, who serves as Lockheed Martin Chairman, President and CEO, said:

“In the third quarter, we advanced our strategic, operational and financial priorities, as demonstrated by our record backlog of more than $165 billion, 48 F-35 deliveries, increased production on missile programs, and $2.1 billion of free cash flow generation.”

Lockheed Martin Q3 Earnings Miss Sparks Stock Forecast Debate

The Lockheed Martin 10-Q filing actually revealed earnings per share of $6.80 compared to $6.73 in the prior year, though the absolute earnings were down quite a bit. This earnings miss is impacting defense stock performance, and now analysts are finding the LMT share price forecast more uncertain as they try to figure out what comes next.

Revenue Growth Gets Offset by Some Margin Pressures

Even with the Lockheed Martin Q3 earnings challenges that they’re facing right now, total sales actually increased 1% year-over-year to $17.1 billion. The Lockheed Martin 10-Q filing showed mixed results across segments, with Aeronautics managing to achieve $6.5 billion and Missiles and Fire Control reporting over $3 billion in quarterly sales.

Jesus Malave Jr., who is the Chief Financial Officer, had this to say on the topic:

“With one quarter remaining, we’ve shifted to approximate point estimates that reflect increased expectations for sales, segment operating profit, earnings per share and free cash flow.”

Also Read: 2 Dividend Stocks Down More Than 10% to Buy & Hold Forever

The company’s defense stock performance continues to face some headwinds from supply chain disruptions and also program-specific losses. However, management remains pretty optimistic about Lockheed Martin revenue 2025 prospects, citing record backlog levels along with strong demand across all their business segments.

Also Read: Robinhood Stock Hits Record High After Tokenized Stocks, Arbitrum Deal

Strong Cash Flow Generation Even With Earnings Volatility

Even the lockheed Martin Q3 earnings pressures that they are facing, the free cash flow went up to 2.1 billion dollars in the quarter, which shows that the company is able to create cash even with what they are going through. Analysts are currently splitting quite a bit on LMT stock price projections, with some analysts pushing for prices up to $600 (based on projected future defense spending) while others are calling for share prices to drop down to $406 (based on the company’s quarter-to-quarter performance).