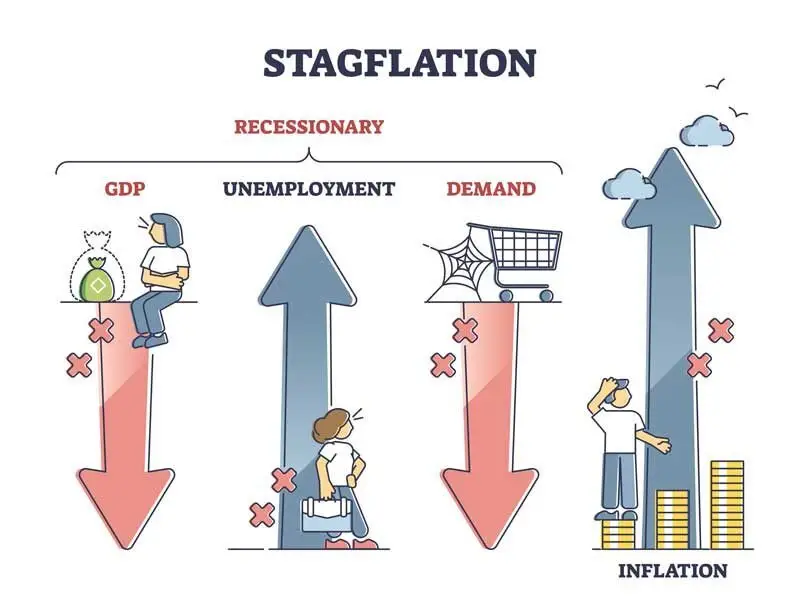

JPMorgan’s CEO sounds alarm on stagflation as the bank’s chief executive warns that stagflation risks in the US economy remain elevated amid mounting economic pressures. Jamie Dimon dismissed suggestions that America is in a “sweet spot” during today’s Global China Summit in Shanghai, and also highlighted market volatility and inflation concerns that could trigger a period of economic stagnation combined with rising prices.

Also Read: CBDC Battle: Renminbi Leads $986B As 134 Nations Race to Kill USD

Navigating Stagflation Risks, Market Volatility, And Crypto Regulatory Challenges

Banking Chief’s Economic Warning Signals Trouble Ahead

JPMorgan Chase CEO Jamie Dimon said that he can’t rule out that the US economy will fall into stagflation as the country faces huge risks from geopolitics, deficits, and price pressures.

In a recent interview at the lender’s Global China Summit in Shanghai, Dimon said, “I don’t agree that we’re in a sweet spot.”

The JPMorgan CEO sounds alarm on stagflation by pointing to specific economic indicators that suggest stagflation risks in the US economy could materialize faster than many economists anticipate right now. He added that the US Federal Reserve is doing the right thing to wait and see before it decides on monetary policy, as per the report.

“I think the chance of inflation going up and stagflation is a little bit higher than other people think,” Dimon had previously said, reinforcing his current warnings about economic conditions and also addressing concerns that many analysts have been raising.

Federal Reserve Policy And Market Conditions

The banking executive praised the Federal Reserve’s cautious approach to monetary policy decisions at this time. Market volatility and inflation pressures have been mounting since the Federal Reserve decided to hold interest rates steady earlier this month, and also warned that risks of higher inflation and unemployment had risen.

This development further clouded the US economic outlook as policymakers grapple with the impact of US President Donald Trump’s tariffs. Recent data has suggested some resilience in the US economy, although the Fed has flagged risks from rising inflation and unemployment right now.

Separate surveys have shown a deterioration in consumer sentiment and increased inflation expectations because of the tariffs, creating additional market volatility and inflation concerns that continue to affect investment decisions across multiple sectors.

Also Read: Bitcoin Overtakes Amazon’s $2.1 Trillion Market Cap Once Again: Apple Next?

Trade Policy Impact On Economic Stability

US President Donald Trump rolled out punishing “reciprocal” tariffs on both friends and foes alike in early April, but later partially delayed the levies in a bid to give White House officials more time to negotiate dozens of individual trade agreements.

Duties on China have also been temporarily paused and lowered, bolstering hopes for a cooling in global trade tensions at the time of writing. Still, baseline 10% tariffs and levies on items like steel, aluminum, and autos remain in effect right now.

By some estimates the US effective tariff rate is also above where it was at the start of Trump’s second term in power and at the highest level since the 1930s, contributing to market volatility and inflation concerns that JPMorgan CEO sounds alarm on stagflation about. This situation has created regulatory uncertainty in crypto markets and other investment sectors today.

Congressional Budget Debates And Deficit Concerns

Regulatory uncertainty in crypto markets reflects broader policy instability as Congress debates major fiscal legislation right now. Separately, Dimon said he would like to see more “certainty” around a massive tax and spending package currently being debated in Congress.

“I’d rather get that done,” Dimon said. However, he flagged that US lawmakers will need to address the country’s “deficit problem.”

The US House of Representatives is tipped to hold a pre-dawn vote on Trump’s “big, beautiful” budget bill, with Republicans in power in the chamber hoping to overcome days of internal disagreements over the measure. Along with the extension of 2017 tax cuts, the legislation would slash taxes charged on tips and car loans, while boosting spending on defense and border security.

The bill also includes reductions to key food and health programs for low-income Americans at this time. Nonpartisan analysts have said the changes would add between $3 trillion to $5 trillion to the US’s $36.2 trillion debt load, creating additional stagflation risks in the US economy in coming years and also affecting long-term fiscal stability.

Also Read: OKX Drops 1:1 Bitcoin Token on Solana, Sui & Aptos, DeFi Gamechanger

China Market Commitment Despite Tensions

Despite rising US-China tensions, JPMorgan maintains its commitment to China’s market financial outlook through continued operations and strategic positioning right now. The bank’s Global China Summit in Shanghai demonstrates ongoing engagement with the region’s financial sector, even as geopolitical pressures create additional regulatory uncertainty crypto and traditional investment sectors face.