JP Morgan, a leading banking giant, has selected Bitcoin as the ultimate savior for the long run, rejecting gold’s soaring price performance as of late. The banking lead has shared how it believes Bitcoin will perform better in the future rather than gold, stating how BTC packs a bunch of benefits for institutions to bask in for the long run.

Also Read: Bitcoin Fell To $15k In 2022, Then Hit $100k In 2024: A Pattern?

Why Is JP Morgan Bullish on Bitcoin?

As per the latest statement shared by JP Morgan, its quantitative strategist, Nikolaos Panigirtzoglou, stated how gold’s outperformance of Bitcoin’s since last October, with a sharp rise in gold’s volatility, has now made Bitcoin appear more lucrative than ever.

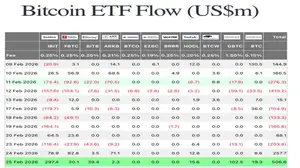

The expert went ahead to note how the crypto market has lately been witnessing violent fluctuations but has kept its footing strong, noting modest outflows as compared to last quarter.

“JPMorgan’s key point: Bitcoin’s risk-adjusted profile versus gold has strengthened. Its volatility relative to gold has fallen to a record low, implying significant upside potential over the long term.”

CryptosRUs, a leading expert on X, further broke down JP Morgan’s bullish Bitcoin sentiment. The portal noted how Bitcoin’s volatility is now “cooling,” packing long-term benefits for the world to take note of.

“J.P. Morgan’s strategists are now favoring #Bitcoin over gold for the long term, and the implications for institutional capital are massive. Risk-Adjusted Dominance: As Bitcoin’s volatility cools, it’s becoming a “mathematical peer” to gold, not just a speculative play. The $170k Target: By aligning Bitcoin’s risk profile with gold, analysts see a clear path to a six-figure valuation based on portfolio parity. Mechanical Adoption: This isn’t about “believing” in crypto; it’s a mechanical reallocation of wealth into assets with fixed supply.”

Path to Triple-Figure Rise?

According to Coincodex BTC Stats, Bitcoin may surge and spike to hit $177K latest by 2030.

“Bitcoin is forecasted to hit $82,384 by the end of 2026 (+26.98% compared to current rates), $166,372 by 2030 (+156.44%), $968,339 by 2040 (+1,392.55%), and $1.45M by 2050 (+2,139.40%). All values represent end-of-year price estimates according to our models. Last update: Feb 6, 2026 – 07:55 AM (GMT+5).”

Also Read: Stifel Warns Bitcoin Price Could Drop to $38K: When Will BTC Recover?