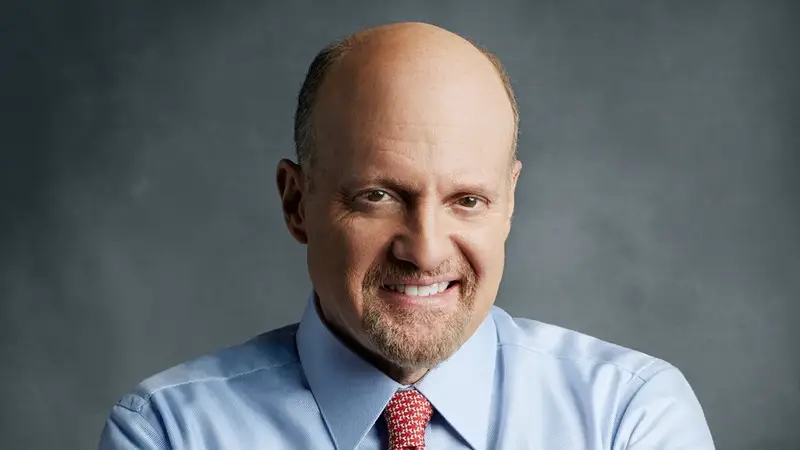

CNBC’s Jim Cramer believes that potential rate cuts next week and possibly again in December provide a “bullish backdrop” for the overall stock market. The market this week was overall a tick down in the past week, but in the past month, the Nasdaq outperformed the S&P and Dow Jones Index. Cramer on Friday morning highlighted three stocks that could bring forth positive gains in the currently “oversold” market: CRWD; BLK; and AMD.

It should be noted that it’s important to conduct your research before getting involved in the stock market, as there are as many risks as rewards. However, here are Jim Cramer’s top 3 stocks entering November 2024.

Jim Cramer’s Top 3 Stocks To Buy Now

BlackRock (BLK)

Jim Cramer highlights BlackRock (BLK) as a good opportunity to invest in now. Currently, BLK is below his basis, suggesting an undervalue to capitalize on. The stock is up 4 points on the market today and has climbed 4% in the past 30 days to 985.29. The firm applied Wednesday with the SEC seeking approval to create exchange-traded fund classes for its mutual funds. Its Bitcoin ETF has been a huge success since its launch earlier this year, seeing billions in inflows.

BlackRock Inc. also received approval from Saudi Arabia to set up its regional headquarters in Riyadh. According to the company, with the move, BlackRock will be able to expand its operations across the Middle East. All of these factors mean potential movement for the company’s stock, which Cramer says will be upward.

Also Read: Walmart Gets Boosted Price Target as WMT Reaches Record High

Advanced Micro Devices (AMD)

Advanced Micro Devices (AMD) is another premium stock that Cramer has recently discussed making a move on. The company has emerged as a prominent company within the semiconductor sector, especially among PC manufacturers. Speaking about AMD, Cramer shared the following:

“AMD reported a strong set of results this evening, partially fueled by demand for their AI chips, the only ones that come close to Nvidia’s. However, they also gave you some not-so-hot guidance for the current quarter because they’re worried about supply constraints. The demand for these chips is off the charts, but they may not be able to make enough of them because there’s only so much high-end semiconductor capacity worldwide. Now to me, silly little me, that seemed like a high-quality problem. But it’s a problem nonetheless, which is why the stock got slammed in the after-hours trading.”

The AI market is currently booming, with chip darling Nvidia (NVDA) leading the charge. AI stocks hold great promise for delivering high returns.

Also Read: Tesla (TSLA) Stock Ends October Down 6%: Here’s Why

CrowdStrike (CRWD)

CrowdStrike (CRWD) is performing well during Friday’s trading session, up 2% to over $300. The stock has seen 7% growth in the past month, but even then, is trading a little bit below Cramer’s cost basis of $307.08. Furthermore, CRWD features in Jim Cramer’s Charitable Trust fund, a portfolio for CNBC investing club members.

CrowdStrike is still targeting $10 billion in annual recurring revenue by its fiscal year 2031 and a midpoint free cash flow margin of 36%. TipRanks’ latest forecast indicates a ‘strong buy’ for CRWD with an average price target of $323. That’s an uptick and return on investment (ROI) of approximately 10.5% from its current price of $293. An investment of $1,000 could turn into $1,100 if the forecast turns out to be accurate within the next 12 months.