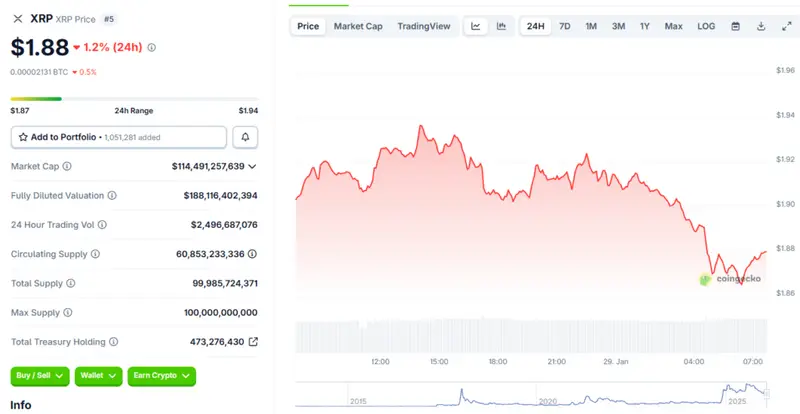

Is XRP just a hype token riding on social media buzz, or does it actually have real substance behind it? That question keeps coming up as we head into 2026. XRP trades around $1.88 right now, and people can’t seem to agree on what that means. Some see a bridge currency with real potential. Others think XRP is just a hype-driven narrative that’ll eventually crash when reality sets in.

The XRP price prediction landscape for 2026 looks messy. You’ve got institutional money flowing into ETFs on one side. On the other side, you’ve got the XRP skeptic crowd pointing out that banks use Ripple’s tech without touching XRP itself. So is XRP just a hype bubble or something more? The divide keeps growing.

Also Read: Trump XRP Playbook Begins, Driving Market Drop

XRP Skeptic Concerns, Price Prediction, Lies, and Market Downturns

Big Money Says One Thing, Charts Say Another

Geoffrey Kendrick from Standard Chartered thinks XRP could hit $8 by 2026, and that’s a significant projection. His XRP price prediction model has leveraged various major quantitative frameworks focusing on ETF flows and regulatory clarity, not speculation.

People asking is XRP just a hype phenomenon usually point to Ripple’s escrow and the billions sitting there. Various major supply releases remain ready to hit the market whenever Ripple decides, such as quarterly unlocks. That’s not exactly the setup for a supply squeeze, and it raises questions.

The Adoption Problem Nobody Wants to Talk About

When you hear people ask if XRP is just a lie or not, they’re talking about this gap, actually. Through numerous significant partnerships, banks have implemented RippleNet but skip XRP for settlements. The technology gets used right now, but the token doesn’t. Across several key financial institutions, this disconnect makes you wonder if the market prices in a future that might never come, and that’s problematic.

That’s harsh but worth thinking about, and it challenges conventional wisdom. XRP’s been around since 2012, leveraging various major technological innovations. If institutional money really saw value, wouldn’t they have bought in years ago, also allocating significant capital? Sure, the SEC lawsuit created uncertainty at the time. But asking is XRP just a hype cycle now that the lawsuit settled, or does clearing that hurdle actually change the fundamental value proposition across multiple essential markets?

Price Action Tells a Different Story

So XRP, why is it going down despite good news, and what’s driving this? The SEC case ended through several key legal resolutions. ETFs launched right now. Yet XRP trades 47% below its $3.65 peak, and that’s significant. People keep asking XRP, why is it going down when fundamentals supposedly improved across various major metrics? Through numerous significant technical indicators, bearish divergence has emerged, suggesting the rally ran on hype more than real demand, also affecting trader sentiment.

Monte Carlo simulations have projected certain critical probability scenarios giving XRP a 60% chance of trading between $1.04 and $3.40 by December 2026. Median outcome sits at $1.88 right now. Across multiple essential stablecoin deployments, banks prefer options like USDC and USDT—they get dollar stability without XRP’s volatility, such as during market downturns.

Understanding XRP and why it is going down comes down to this, and it’s important. Through various major trading patterns, news pumps fade fast when on-chain activity doesn’t back them up. Investors who bought at $3+ sit underwater right now. Across several key price levels, that creates selling pressure every time price approaches their entry points. Many wonder if XRP is just a hype asset at this point, or if there’s a real recovery coming, also considering long-term fundamentals.

Also Read: New Pattern Suggests XRP Is Heading to $21: Here’s When

What Actually Matters Going Forward

The question of whether XRP is a hype or a reality will be answered by Ripple turning partnerships into real-life use of XRP in many major outlets. The XRP price speculation crisis has changed several key analysis paradigms and turned courtroom victories into utility demonstration. Using some important adoption metrics, can XRP demonstrate that it is indispensable to global finance, and does that matter? Currently, ETF inflows are encouraging in a variety of key products.

On-chain measures have shown some decisive flaws? Engaging different larger partnerships, numerous Ripple engagements include testing technology, not using XRP on scale, including pilot projects. The coming few months will count, and will be a telling month. By means of many important developments, either XRP demonstrates that it is structurally important or the question whether XRP is a lie or not continues to bring sentiment down. It remains to be seen which camp proves to be right, which will also determine the future direction of the market.