IRS direct deposit stimulus rumors claiming $2000 payments are false and have no official confirmation from Congress or the Internal Revenue Service right now. These IRS direct deposit stimulus claims have been spreading across social media platforms since early October 2025, and they’re based on misinformation and unverified posts. Americans are not receiving any $2000 direct deposit IRS payment this October, and any legitimate stimulus check in 2025 for NY or federal payment would be announced through official government channels, not through social media accounts or suspicious text messages.

Also Read: IRS 2026 Federal Income Tax Brackets Updated for Inflation

IRS Direct Deposit Stimulus Update, Rebate Plans, and 2025 Facts

The False $2,000 Direct Deposit IRS Claims Spreading Online

Several unverified profiles on X have been writing about these IRS direct deposit stimulus rumors in the past few days. On October 9, somebody posted a statement containing $2000 Direct Deposit to U.S. Citizens in October 2025, and forwarded a report regarding the supposed payment. Another post from October 3 claimed the same thing, which posed the question to the followers: Is this true? Congress or the IRS would have channeled out any genuine informative announcement through the proper channels, so authorities have disapproved such reports as utter falsehood.

By the time of writing, the IRS has already sounded alarm bells on on text frauds and impersonators who could be interested in deceiving individuals regarding tax refunds or new IRS direct deposit stimulus check. These fraudsters usually threaten people into giving out their personal and financial details, that is why it is best to confirm with the IRS any payment claims.

What Actually Happened to Real Stimulus Payments

Three stimulus checks were issued during COVID-era programs, and the last one had an April 15, 2025 deadline to be claimed. The first of these stimulus checks provided up to $1200 for individuals and $2400 for married couples, and also included $500 for each qualifying child under the age of 17. The second stimulus check was up to $600 per individual, $1200 for married couples, and $600 per qualifying child under 17. The third check delivered $1,400 for eligible individuals, and married couples filing jointly got $1400 for each qualifying dependent.

The opportunities to claim or file for these payments have now passed. Even if someone received a tax extension, they still needed to file their 2021 tax return by the April 15, 2025 deadline to claim that third stimulus check, and there are no extensions or appeals available for missed deadlines.

The American Worker Rebate Act and What It Means

An actual IRS direct deposit stimulus update that’s real involves the American Worker Rebate Act of 2025. Missouri Republican Senator Josh Hawley submitted this legislation, and it aims to send between $600 and $2,400 to American taxpaying families. Congress has not passed the proposal as of yet, which means authorities cannot distribute any payments until it receives congressional approval.

President Donald Trump has also floated the idea of using part of the government revenue the new tariffs are generating and returning it to taxpayers of a certain income level in the form of a rebate check, similar to the stimulus checks the government sent during the pandemic. In February, Trump also said he would consider paying out $5000 stimulus checks to taxpayers in the form of a “DOGE dividend” during a summit in Miami, but he has not shared any further details since then.

Also Read: IRS to Furlough Nearly 50% of Staff Amid Government Shutdown

State Relief Programs That Are Actually Happening Right Now

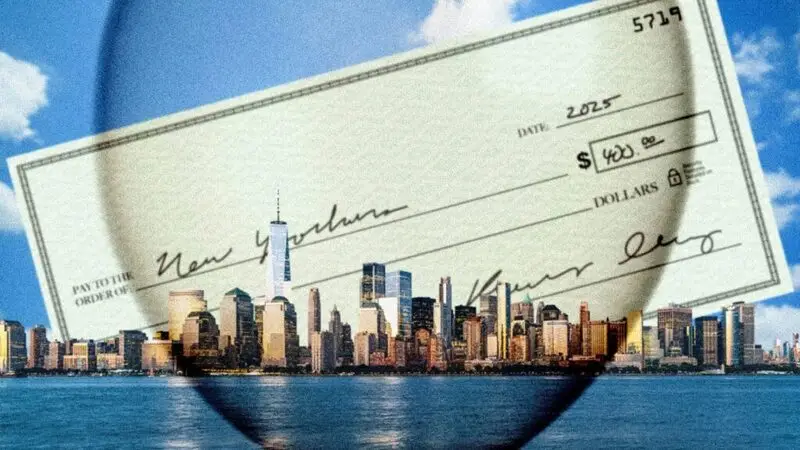

Several states, including New York, have sent or are sending out inflation relief checks to residents who paid higher sales taxes due to inflation. These are one-time payments with varying amounts based on income, and New York residents earning up to $75000 receive $200, while married couples filing jointly earning up to $150000 receive $400. Pennsylvania, Georgia, and Colorado also offered inflation refund checks to property owners or taxpayers with differing criteria and qualifications.

New Jersey residents that haven’t already applied for ANCHOR property tax relief payments still have time to apply using the online form until October 31. The ANCHOR program offers tax relief to New Jersey property owners and renters that meet specific requirements.

How to Verify Legitimate Payments and Avoid Scams

The $2000 direct deposit IRS speculation and stimulus check 2025 for NY rumors demonstrate how quickly false information can spread online. The IRS has an online tool called “Where’s My Refund” that allows people to check on the status of any legitimate refund or payment. This tool requires entering a Social Security number, filing status, and exact refund amount on the return.

If someone filed their federal taxes electronically and included their banking information, then they may expect a direct deposit within 21 days. Once the IRS approves a refund, it could hit a bank account within days via the direct deposit option. The refund information is updated on the IRS website once a day, overnight.

Official IRS communications never arrive via unsolicited text messages demanding immediate action or personal information. Any claims about surprise IRS direct deposit stimulus payments should be verified through the IRS website at IRS.gov or by calling the official IRS helpline at 800-829-1954. The latest text message scam, called smishing, sends phony bills or payment notifications that never existed, and tax professionals recommend deleting suspicious messages and reporting them without clicking any links or providing any information.