Russia’s sanctions have changed how oil moves around the world. They’ve pushed countries away from using U.S. dollars in trade. New data shows major changes in how Russian oil is bought and sold globally. The Russia sanctions tracker shows these measures are making countries move away from dollar-based systems.

Also Read: $3 Trillion Gold Find: Will El Salvador Turn It Into Bitcoin Reserves?

Exploring How Russia’s Sanctions Impact Global Finance and Accelerate De-dollarization

Reshaping Global Oil Trade Routes

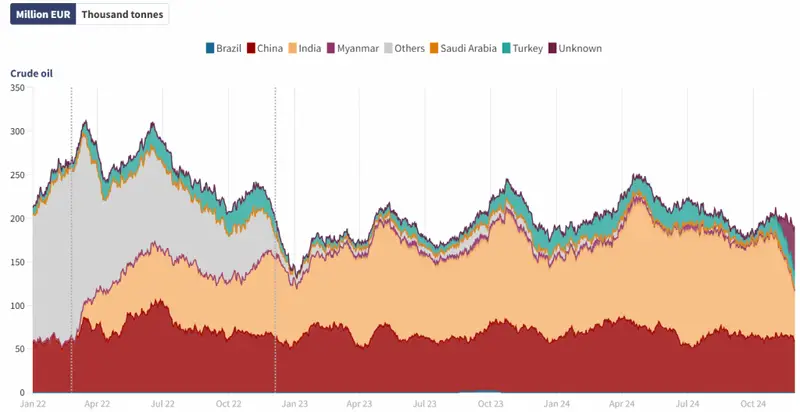

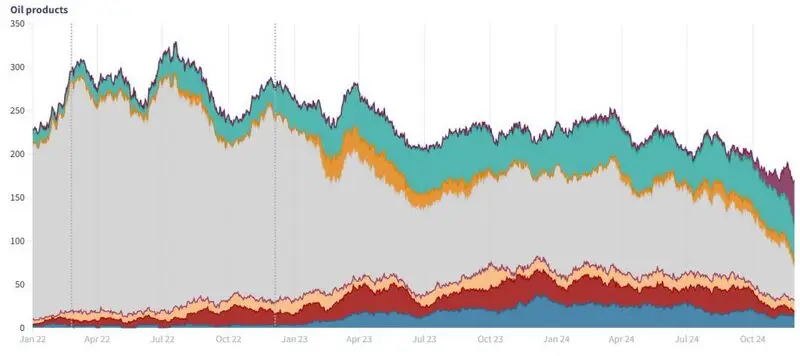

EU and UK Russia sanctions on oil exports have changed trade routes worldwide. CREA analysis shows that India has bought the most Russian oil by sea since the sanctions began, and China has also bought much more. The Russian sanctions cut oil revenue by 23% (EUR 20.3 billion) in year one, speeding up de-dollarization.

The Rise of Alternative Payment Systems

Countries are moving away from dollar trading as Russian sanctions forced Moscow to find new payment methods. Russian oil sales to countries outside the Price Cap Coalition grew by 24% (EUR 12.7 billion). Many deals now happen without dollars, showing clear signs of de-dollarization.

Also Read: USDC Alliance: Binance, Coinbase, and Circle Take on Tether

Price Cap Effectiveness and Enforcement Challenges

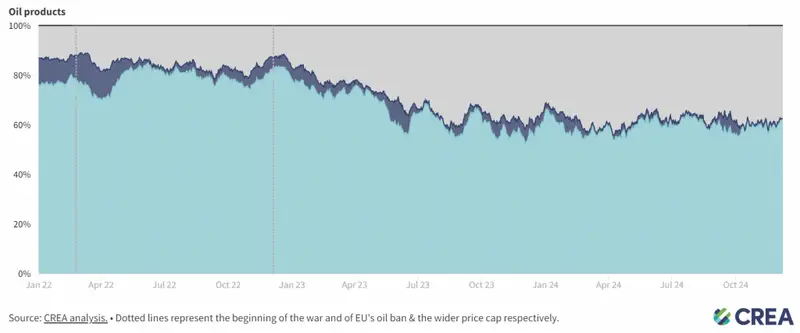

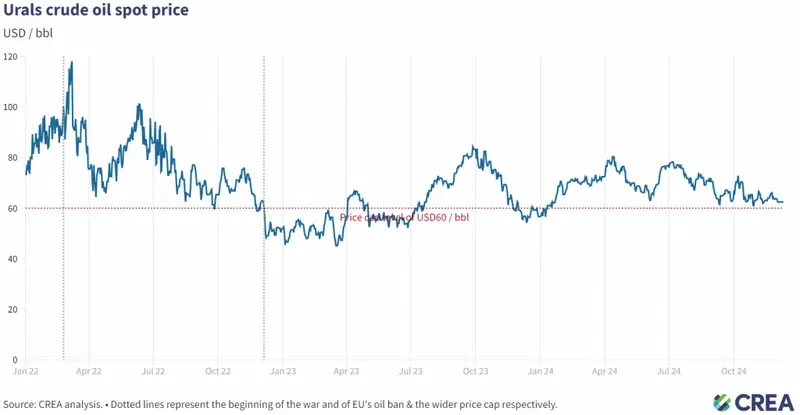

Russia sanctions tracker data shows Western price controls aren’t fully working. Urals crude fell to $45 per barrel in January 2023 but rose to $84 by September 2023, going above the $60 price cap. In October 2023, 62% of Russian oil moved on “shadow” tankers, showing how rules get bypassed.

Also Read: Binance’s BNB To Breach $1000, Hit New ATH: Here’s When

Future Implications for Global Trade

The impact of Russian sanctions is changing world trade and pushing the global financial shift toward new systems. In October-November 2023, Russia made about EUR 36 billion selling fuel outside the Price Cap Coalition. China and India bought 59% (EUR 21.2 billion) of this oil. These sales show how sanctions push countries to trade differently.

“The drop in the price of seaborne exported Russian oil ensured that their losses in revenue were never fully covered,” notes CREA’s analysis, highlighting the complex interplay between Russia sanctions enforcement and market adaptation. This change points to a lasting move away from dollar-based trade, especially in energy markets.

Also Read: Bitcoin’s Biggest Ally? MicroStrategy (MSTR) Joins Nasdaq 100 After $100B Surge