The world’s largest cryptocurrency, Bitcoin (BTC), is exhibiting extreme volatility at the moment. The king coin witnessed a nearly 10% rise throughout the week. BTC surged all the way to a high of $68,261 this week from a low of $59,200 last week. At press time, the asset was trading at $66,873.11 with a 2% drop over the past 24 hours.

Also Read: US Stock: Amazon Eyes New Sector: Will It Help AMZN Spike To $265?

Factors Contributing to Bitcoin’s Potential Surge

Historical Performance and Current Market Sentiment

The latest surge certainly pushed the king coin closer to its all-time high. Currently, BTC stands only 9.27% below its peak of $73,750.07. While the asset endured a slight setback, October was looking extremely bullish for the asset.

Historically, this month has proved to bring in gains for BTC. Apart from this, IntoTheBlock highlighted another factor that could contribute to Bitcoin’s potential spike.

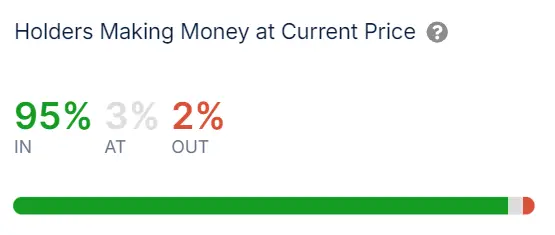

The firm revealed that a staggering 95% of BTC holders were making money at the asset’s current price. A dainty 2% of investors were enduring a loss. Further elaborating on the scenario, IntoTheBlock wrote,

“With 95% of Bitcoin addresses now in profit, market sentiment is booming. Historically, such levels have signaled strong bullish momentum but can also indicate a potential overextension.”

Also Read: Ethereum’s Buterin Explains ‘The Surge’: Will ETH Reach 100K TPS?

Can Bitcoin Hit A New Peak In October 2024?

According to data from Changelly, BTC will indeed have a great month. The king coin is expected to trade at a maximum price of $85,101. This milestone is much higher than Bitcoin’s current all-time high. In addition, the asset is predicted to trade at an average price of $76,762.50.

In addition to the above prediction, Bitcoin could see a much bigger rise if overall market sentiment witnesses a boost. A shift in the regulatory climate could also influence the price of BTC.

Also Read: Top 3 Meme Cryptocurrencies That Could Double Your Investment