Goldman Sachs dollar forecast warns the US currency could actually behave like a risky asset rather than its traditional safe-haven role. The analysis reveals policy uncertainty, fiscal concerns, and also diversification trends are threatening dollar stability right now. Goldman Sachs dollar forecast 2025 shows some increased volatility patterns that have been developing.

Also Read: Crypto Fix for US Deficit: Ex-Goldman Exec Sees Trillions

Goldman Sachs Dollar Forecast 2025 Highlights Risks, Market Outlook

Shifting Patterns Being Revealed Right Now

Goldman Sachs analysts Karen Reichgott Fishman and Lexi Kanter have been tracking these changes. They were clear about the fact that:

“Shifting correlations have left dollar strength in periods of risk-off a less reliable outcome.”

The 2025 Goldman Sachs dollar forecast indicates the currency is actually trading less like a safe haven these days. Data shows correlation between the dollar and the G-10 volatility gauge sits near seven-year lows. This signals increased risk-asset behavior is happening.

At the time of writing, this represents quite a departure from historical patterns where the dollar traditionally strengthened during market stress.

Policy Uncertainty Drives Depreciation Warning

Trump’s trade tariff threats have triggered steep dollar declines this year and the Goldman Sachs de-dollarization analysis points to elevated policy uncertainty around Federal Reserve independence along with trade policies as key risks.

Chief Economist Jan Hatzius had this to say:

“On the economy, it’s going to continue to be a slog. Growth is going to continue to be quite slow.”

GDP has been forecast to expand only 1% in Q4 year-over-year, with recession risk sitting at 30%. This is actually double the historical average. Core inflation is expected to climb to about 3% as tariff rates increase.

Source: US Bureau of Labor Statistics, Census Bureau, Haver Analytics, Goldman Sachs Research

Fiscal Deficits Impact Market Outlook

Goldman Sachs Vice Chairman Rob Kaplan stated:

“We’ve always talked about deficits, but we’re more highly leveraged on a net debt basis than we’ve been in our lifetimes.”

The $2 trillion budget deficit represents about 6-7% of GDP right now. Kaplan also noted:

“When you’re at full employment, or near it, that’s when you kind of deleverage, and it’s in recession that deficits spike up.”

These concerns have been affecting longer-term Treasury yields, and the Goldman Sachs dollar depreciation outlook is being influenced by this fiscal imbalance.

Market Implications of the Forecast

The Goldman Sachs dollar forecast shows the currency has been selling off alongside equities more than twice as often this year versus the prior decade. This pattern is quite striking because it challenges traditional safe-haven assumptions.

Co-head Ashok Varadhan stated:

“We’re not even in the first inning of companies implementing AI.”

Despite dollar concerns, he actually remains bullish on US stocks. The Goldman Sachs de-dollarization trends suggest assets like gold and Bitcoin could benefit as investors diversify away from traditional fiat currencies.

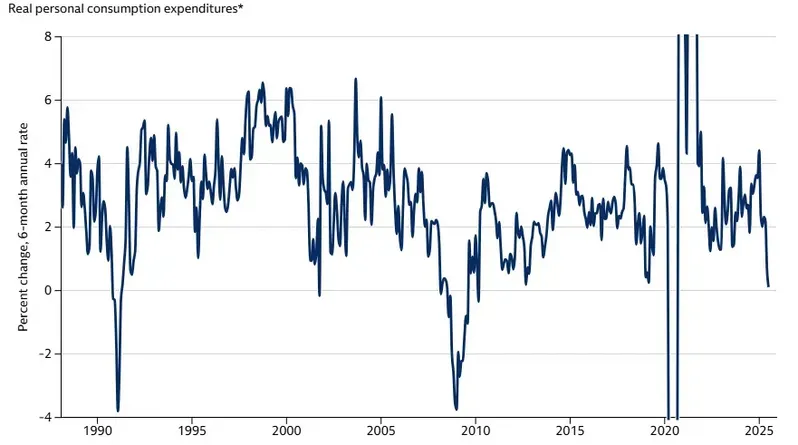

Hatzius expects consumer spending will be affected because tariffs are weighing on purchasing power. He mentioned that consumer spending “has stagnated, which doesn’t often happen outside of recession.”

Also Read: Goldman Sachs Cuts India GDP Forecast as Trump Threatens 25% Tariffs

The Goldman Sachs 2025 market outlook indicates continued dollar volatility will be driven by policy uncertainty and also fiscal imbalances that are developing.