The gold price has lately been rising steadily. The asset has now entered its parabolic stage, with geopolitical tensions and uncertainties acting as perfect fuels driving the surge ahead. In the middle of this, multiple analysts and leading banking institutions have started to bank on gold’s long-term surge, as bearish US dollar scenarios continue to multiply. If gold is at $5000 an ounce right now. Where will it be after 5 years or more? Here’s the new gold price prediction for the next 5 years.

Also Read: Gold ATH Price Crosses $5,000 in Historic Safe-Haven Rally

Gold Price Overhaul: Drivers Fueling Its Surge

Gold and silver have now become two of the most powerful assets to date. With crypto and stocks adopting a stable outlook, 2026 seems to be favoring the metals sector the most, with both the assets climbing high on the price radar at an extraordinary speed. Gold’s primary price support is currently the geopolitical mayhem and brawls, with the US-Greenland agenda heating up. That being said, the global banks’ gold buying spree is also ramping up gold’s demand, which again is assisting the asset in ranking up on the public radar.

“China continues to stockpile gold behind the scenes. China acquired +10 tonnes of gold in November, ~11 times more than officially reported by the central bank, according to Goldman Sachs estimates. Similarly, in September, estimated purchases reached +15 tonnes, or 10 times more than officially reported. Furthermore, China officially bought an additional 0.9 tonnes in December, pushing the total gold reserves to a record 2,306 tonnes. This also marked the 14th consecutive monthly purchase. In 2025, China’s total reported gold purchases reached +27 tonnes. Assuming official purchases were 10% of what China is actually buying, this suggests China acquired +270 tonnes of physical gold in 2025.”

Gold Price Prediction for the Next 5 Years

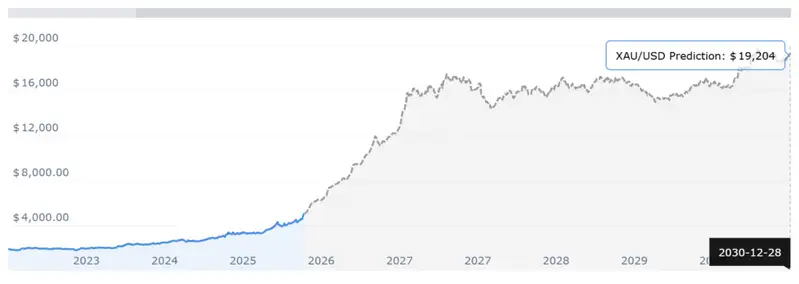

According to CoinCodex gold stats, gold may hit a new price high of $19409 by the end of 2030.

“The price of gold is forecasted to hit $12,187 by the end of 2026 (+139.62% compared to current rates) and $19,409 by the end of 2030 (+281.61%). All values represent end-of-year price estimates according to our models. Last update: Jan 27, 2026 – 02:56 PM (GMT+5).”

Also Read: BRICS: Foreign Central Banks Hold More Gold Than US Treasuries