Gemini IPO priced $28 with oversubscribed demand has raised $425 million, and it’s representing one of the most successful cryptocurrency exchange IPO launches in recent market history right now. The IPO priced $28 per share, which was significantly above what they initially expected, while oversubscribed demand reached over 20 times the available shares. The NASDAQ listing will commence Friday under ticker symbol “GEMI.”

Gemini IPO Priced $28 With Oversubscribed Demand & Nasdaq Listing Surge

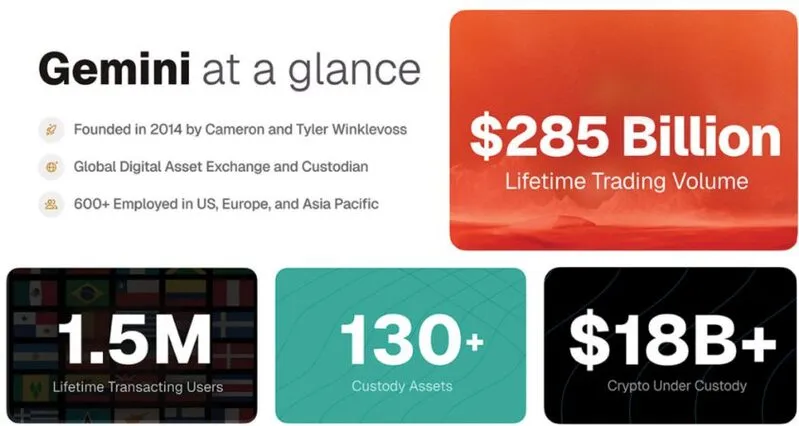

The Gemini IPO attracted massive investor interest, and the oversubscribed demand actually forced the company to cap proceeds at $425 million. Founded by Cameron and Tyler Winklevoss back in 2014, the cryptocurrency exchange IPO initially targeted a $17-$19 price range before it was raised to $24-$26, ultimately settling at the IPO priced $28 level.

Record-Breaking Subscription Levels

The Gemini IPO received more than 20 times as many orders as there were available shares, which created unprecedented oversubscribed demand in the crypto sector right now. Goldman Sachs and Citigroup, who are serving as lead bookrunners, actually stopped accepting new orders due to the overwhelming interest. The cryptocurrency exchange IPO demonstrates some strong institutional appetite for digital asset companies.

At the time of writing, NASDAQ listing partner invested $50 million in a private placement alongside the offering, further validating the Gemini IPO opportunity.

Also Read: India Hits Back at Trump On BRICS: Don’t Dictate Our Business Choices

Financial Performance and Market Position

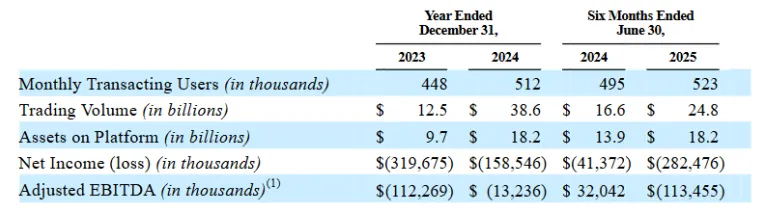

Gemini operates across 60+ countries with $285 billion lifetime trading volume and 1.5 million transacting users actually using the platform. The platform holds over $18 billion in crypto assets under custody, including 4,002 Bitcoin and 10,444 Ethereum as of June 2025.

The company posted a net loss of $282.5 million in H1 2025, compared to $41.4 million the previous year. Revenue declined to $68.61 million from $74.32 million, though the successful cryptocurrency exchange IPO suggests investor confidence in long-term growth potential.

Market Impact and Trading Debut

The Gemini IPO will begin NASDAQ listing Friday, and up to 30% of shares were reserved for retail investors through platforms like Robinhood and Webull. At the IPO priced $28 level, the company actually achieves a market valuation of approximately $3.3 billion right now.

The oversubscribed demand reflects broader momentum in crypto listings, following successful debuts by Circle Internet Group and Figure Technology this year.

Also Read: 97% of US Importers Are Small Businesses: Aug 1 Tariffs Crushes Their Dreams