G7 central banks are, at the time of writing, responding in different ways to the US economic chaos that has followed President Trump’s recent trade war. Right now, the ECB is planning to cut rates while the Bank of Canada continues to focus on inflation amid the ongoing trade tensions with the US. These different approaches actually showcase how G7 central banks are trying to navigate the complex global financial impact created by the current US economic instability.

Also Read: If You Invested $1,000 in Shiba Inu at Its All-Time Low, Here’s Your Returns

How G7 Central Banks Are Responding to US Economic Instability and Inflation Concerns

ECB Set for Rate Cut

G7 central banks on the European side are currently preparing to ease monetary policy. The ECB rate cut of a quarter point is widely expected this Thursday as European policymakers are working on their first response to the market turmoil triggered by US chaos.

ECB president Christine Lagarde stated:

“Price stability and financial stability go hand-in-hand.”

This marks the second time in just over two years that ECB officials have had to face crucial decisions amid financial turbulence originating from the United States. Unlike after the Silicon Valley Bank collapse when they decided to deliver a planned half-point hike, the current conditions seem to be pointing toward monetary easing as Trump’s tariffs continue to threaten the European economy.

Canada’s Inflation Balancing Act

G7 central banks across the Atlantic are also facing challenges, though of a different nature. The Bank of Canada will most likely keep rates unchanged on Wednesday due to Canada’s inflation concerns during the ongoing US tariff disputes.

Canadian officials must try to balance competing factors – US tariffs are already hurting business investment and consumer spending while inflation expectations remain stubbornly high. The consumer price data coming out on Tuesday will be extremely crucial for their final decision.

Also Read: De-Dollarization: China Dumps $23 Billion Worth of US Dollars

The situation faced by the Bank of Canada demonstrates how G7 central banks must adapt their policies to external pressures coming from US economic instability while also trying to protect their domestic economies.

Federal Reserve’s Response

While European and Canadian G7 central banks are acting first, the US Federal Reserve won’t actually make its next policy decision until May 7. However, various Fed officials will be offering their economic assessments throughout the week.

Fed Chair Jerome Powell will speak on Wednesday at the Economic Club of Chicago, with regional Fed presidents also discussing economic conditions. Investors will carefully scrutinize these statements for any clues about potential rate adjustments amid rising Treasury yields, a weakening dollar, and the ongoing stock market volatility tied to US trade policy.

Global Central Bank Decisions

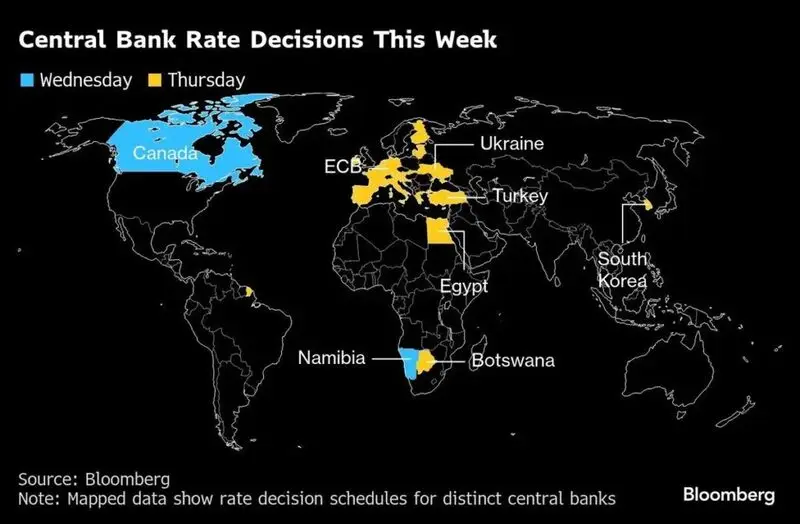

The impact of US economic chaos extends well beyond just the G7 central banks. Several other central banks are also making important policy decisions this week, including South Korea, Turkey, Egypt, Namibia, and Botswana.

Also Read: Mantra Token’s 90% Drop: Reckless Liquidations or Insider Trading?

Turkey faces a particularly difficult decision amid the recent market turmoil, while Egypt might begin easing despite potential complications from US tariff-related money outflows. These diverse responses highlight how US economic instability creates ripple effects that require customized policy approaches worldwide.

As G7 central banks continue to navigate these challenges, their decisions will significantly influence how global markets weather this uncertain period. The divergent responses reflect the complex reality that different economies are affected by US chaos in different ways, which necessarily requires tailored monetary policy strategies.