The Fed rate cut scheduled for today marks a pivotal moment for markets. Economists predict a 0.25 percentage point drop to 4.25%-4.50%. This third rate cut of 2024 has sparked changes in crypto prices. Bitcoin fell to $104,000 after reaching $107,000 on Tuesday. The entire crypto market now faces rising uncertainty after the Fed rate cut.

Also Read: Dogecoin: Here’s How To Be a Millionaire When DOGE Hits $3.2

How Fed Rate Cuts Affect Cryptocurrency Market Volatility and Interest Rates

Market Response to Today’s Fed Decision

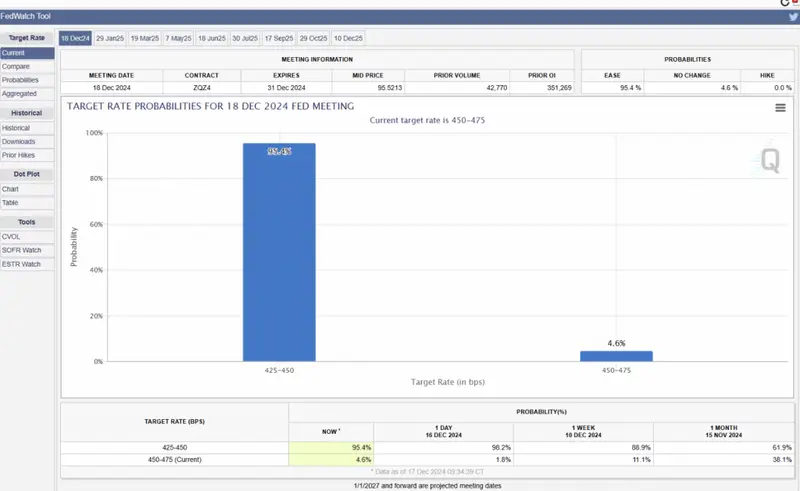

The CME FedWatch Tool shows a 95.4% chance of a 25-basis-point Fed rate cut. Only 4.6% think rates will stay the same. “The Fed will likely move ahead with another 25-basis point cut at its December meeting,” notes Jacob Channel, senior economist at LendingTree. Crypto prices reflect this outlook. Ethereum dropped 4.5%. The total crypto market value fell to $3.8 trillion following the Fed rate cut news.

Economic Indicators Supporting the Rate Cut

November saw 2.7% inflation, meeting expectations. The economy added 227,000 jobs. Goldman Sachs economists state: “Fed officials might prefer to be cautious in light of uncertainty about the new administration’s policies, especially possible tariff increases.” These numbers support today’s Fed rate cut. Rates have dropped one full point since September.

Also Read: Expert Predicts List Of New Crypto ETFs That May Launch In 2025

Crypto Market Impact and Current Trading Patterns

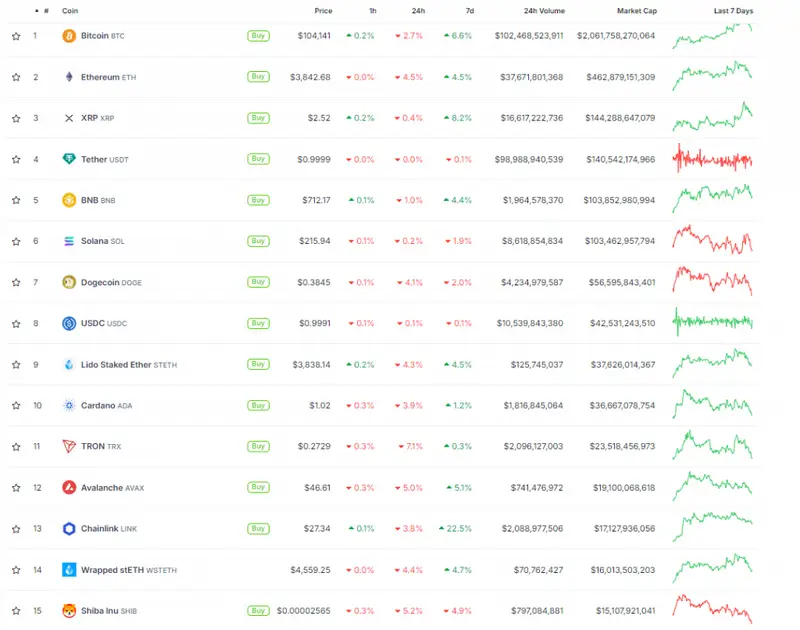

Crypto prices showed big swings before the Fed rate cut news. Bitcoin’s price sits at $104,141. It fell 2.7% today but gained 6.6% this week. Ethereum dropped more, losing 4.5% to reach $3,842. XRP stands out with an 8.2% weekly gain, which comes amid the Fed rate cut.

BNB fell 1.0%, while Solana dipped 0.2%. Bitcoin traders moved $102 billion worth in the last 24 hours. Chainlink rose 22.5% this week, going against the market trend. Tether keeps things stable with $99 billion in daily trades, helping market flow stay smooth. This stability contrasts with more volatile cryptos, especially around Fed rate cut announcements.

Future Rate Cut Outlook

EY chief economist Gregory Daco thinks the Fed might plan “three rate cuts in 2025 of 0.25 percentage points each, down from four rate cuts the central bank had penciled in when it last released the SEP, in September.” This change comes from inflation staying above 2% and questions about future economic rules. This will likely impact crypto markets as they react to the rate cut announcements over time.

Also Read: How to Withdraw XMR from Kraken?

Immediate Market Implications

The Fed will announce its choice at 2 p.m. EST, and Fed Chair Powell will speak at 2:30 p.m. EST, which will undoubtedly further influence crypto and general market trends.

That said, interest rates and crypto prices keep shifting, as Diane Swonk, chief economist at KPMG, notes: “The economy remains stronger than participants at the meeting thought it would be when they started cutting in September, while improvements in inflation appear to have stalled.” The ongoing dialogue about Fed rate cuts continues to create significant market movements.

Traders bought more options on major cryptos to prepare for price swings after the news of the rate cut.