Closely followed crypto analyst Benjamin Cowen says that a shift in monetary policy will most likely be what finally triggers an “altseason,” or a period where altcoins vastly outperform Bitcoin (BTC).

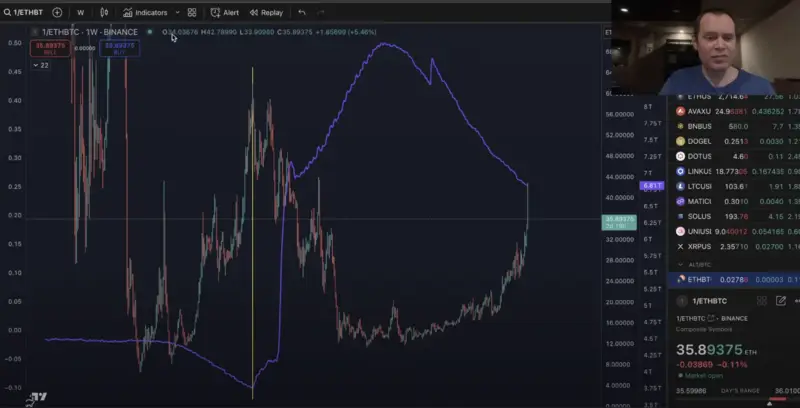

In a new strategy session, Cowen overlays the Fed balance sheet with Ethereum (ETH) versus Bitcoin (ETH/BTC) and notes that in previous market cycles, altseasons didn’t kick off until the Fed ended quantitative tightening (QT) and increased the assets on its balance sheet.

“What allowed for [the forecast] was just the understanding of tighter monetary policy, and knowing that last cycle we did not see ETH/BTC bottom or the inverse of that top, we didn’t see the BTC/ETH valuation top until the Fed ended quantitative tightening…

And so, you can see that the Fed has been doing the same exact thing this cycle and throughout this process just like last cycle, ETH has lost value to Bitcoin. Now the same could be said about a lot of altcoins…

And in fact, if you look at a basket of alts, you can see that in fact, they have put in new lows this week, and my argument has always been, that they will likely eventually go to the range low before there’s really a great hope of any altseason being able to occur. You could also look at OTHERS/BTC, and see that it has just dropped since 2022 began.

There’s a lot of people who call this the ‘memecoin supercycle’ and they try to get you pumped up for alteason and saying that these memecoins are going to outperform, but at the end of the day they just keep bleeding out to Bitcoin.”