European banks’ crypto services enter a new era as big banks like Garanti BBVA get ready to launch crypto trading across the EU. The Markets in Crypto-Assets (MiCA) regulation is now fully active, and banking and cryptocurrency will grow fast in 2025. Over 50 banks plan to start crypto trading services to meet customer needs for digital assets.

Also Read: X Money Payment System Set for 2025 Launch: Will Dogecoin Be Included?

European Banks To Expand Crypto Trading Services Amidst Market Volatility

BBVA Leads the Crypto Banking Revolution

Spanish bank BBVA leads cryptocurrency adoption through its Turkish branch, Garanti BBVA Kripto. Turkey’s fifth-largest bank will soon let anyone trade crypto using Bit2Me’s platform. “We are in very close contact with more than 50 financial institutions, with banks all across Europe and internationally, and they will start launching their services in the first quarter of 2025,” states Abel Peña, Bit2Me’s chief sales officer.

Major Banks Following Suit

European banks’ crypto services grow as banks see rising demand. BBVA owns $857 billion in assets and shows how banking and cryptocurrency work together. Garanti BBVA Kripto’s crypto trading services mark a big step in European crypto regulation.

Established Players Embrace Digital Assets

Deutsche Bank and Société Générale already work with crypto. Deutsche Bank builds on Ethereum with ZKsync, while SG-FORGE plans a euro coin on XRP Ledger. These moves show how cryptocurrency adoption changes banking.

Also Read: Top 3 Cryptocurrencies To Watch This Weekend

Regulatory Clarity Drives Market Growth

MiCA lets European banks offer crypto trading services with confidence. “We’re talking about an asset [bitcoin] that many users and companies want to gain exposure to. This is something that banks cannot deny anymore,” says Peña. Clear rules help more banks explore crypto trading services.

Future Prospects and Market Impact

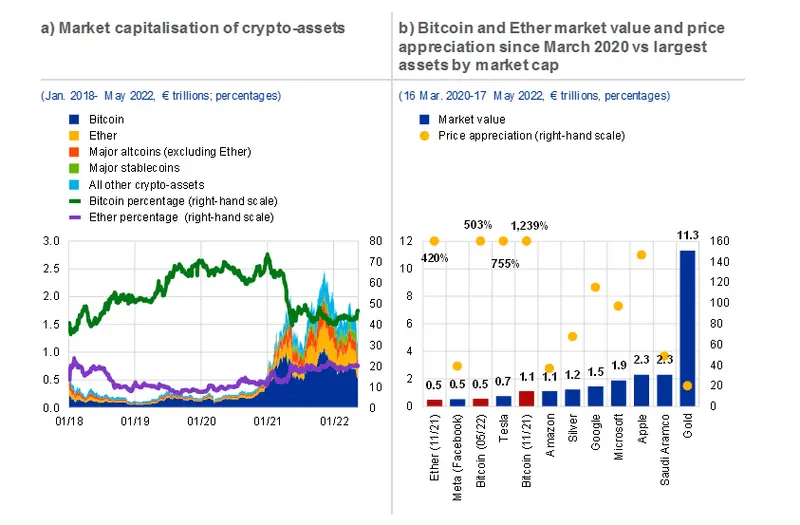

U.S. bitcoin funds drew in $35 billion, showing high demand for European banks’ crypto services. As banking and cryptocurrency merge, European banks get ready to help customers buy digital assets.

Also Read: VeChain (VET) On Pace to Return to $0.1: Here’s When