The Ethereum warning from JPMorgan has sent shockwaves through the cryptocurrency community as the banking giant raises serious concerns about ETH’s future prospects right now. The latest Ethereum warning highlights declining institutional demand and also troubling market indicators that could significantly impact Ethereum price prediction models going forward. JPMorgan’s analysis reveals that Ethereum staking participation may not be enough to offset broader institutional investor concerns about the network’s long-term viability at the time of writing.

Ethereum's latest upgrade, Pectra, boosts institutional appeal, JPMorgan analysts say. $ETH

— SQWARE (@sqwareterminal) May 29, 2025

Ethereum Warning: JPMorgan Predicts Bleak Outlook for ETH Price

JPMorgan’s comprehensive Ethereum warning centers on the Chicago Mercantile Exchange futures market, where both Bitcoin and also Ethereum contracts are approaching backwardation right now. This critical shift occurs when futures prices fall below spot prices, indicating weakening institutional demand from major players who typically use regulated CME futures contracts for crypto exposure.

The banking giant’s Ethereum price prediction analysis reveals concerning trends despite recent network upgrades and improvements. The Pectra upgrade, while improving protocol efficiency, failed to generate substantial user growth or network adoption that institutional investors expected to see at this point.

Institutional Investors Retreat as Ethereum Warning Materializes

JPMorgan analysts identified two primary factors behind declining institutional investor appetite for Ethereum futures right now. First, major funds are securing profits due to uncertainty about immediate positive catalysts in the crypto space and also concerns about regulatory clarity. Second, momentum-driven funds including commodity trading advisors have reduced their Ethereum staking and trading exposure significantly.

The Ethereum warning becomes more pronounced when examining momentum signals, which have weakened considerably for both Bitcoin and Ethereum over recent months. Ethereum’s momentum indicators have already entered negative territory, suggesting continued institutional investor withdrawal from the market at the time of writing.

Also Read: Ethereum Pectra Upgrade Price: ETH Surges 18% to $2,200

Network Usage Contradicts Ethereum Price Prediction Optimism

Despite technological improvements and upgrades, JPMorgan’s Ethereum warning emphasizes that on-chain activity remains flat right now. The network shows minimal growth in decentralized finance applications, with total value locked remaining underwhelming despite increased institutional investor interest in regulated futures markets and also growing awareness.

The Ethereum warning also addresses declining transaction fees, which paradoxically signal reduced network demand rather than user-friendly improvements. Layer-2 solutions continue capturing transaction volume from the main Ethereum network, reducing primary layer revenue and undermining bullish Ethereum price prediction scenarios at this time.

Supply Inflation Challenges Ethereum Staking Economics

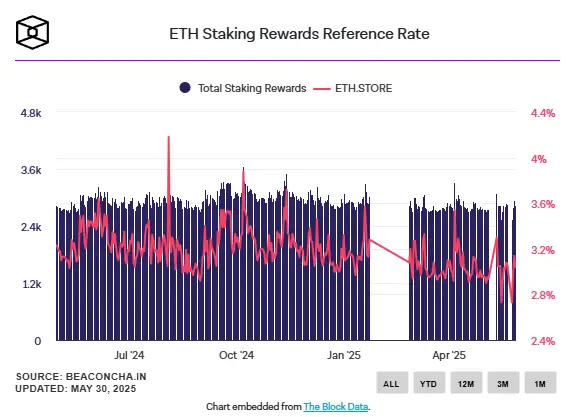

JPMorgan’s Ethereum warning reveals that recent upgrades have increased supply inflation, with ETH burn rates dropping significantly right now. This development threatens the “ultrasound money” narrative and also creates headwinds for Ethereum staking reward structures that institutional investors rely upon for yield generation.

While nearly 70% of institutional investors engage in Ethereum staking according to recent surveys, JPMorgan’s Ethereum warning suggests this trend may not continue at current levels. The banking giant’s Ethereum price prediction models factor in reduced institutional demand and also flat network usage as key bearish indicators moving forward.

Also Read: Solana Vs. Ethereum: Here’s Why SOL May Dethrone ETH In 2025

The comprehensive Ethereum warning from JPMorgan indicates that institutional investors should reconsider their Ethereum price prediction assumptions and also their Ethereum staking strategies until the network demonstrates substantial improvements in adoption and usage metrics right now.