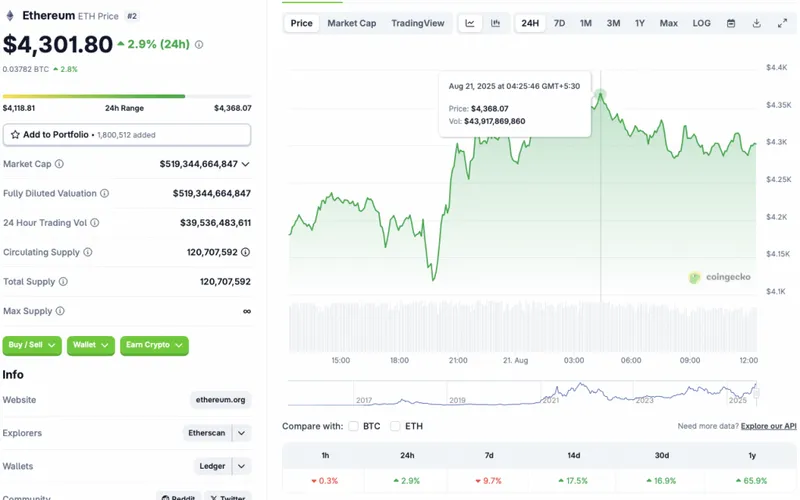

Ethereum (ETH) made quite a recovery today, registering more than 3% gains in the daily charts at one point. ETH’s price hit $4368.07 earlier today, but has since fallen to $4301.80. According to CoinGecko’s ETH data, the second-largest crypto by market cap is currently up by 2.9% in the daily charts, 17.5% in the 14-day charts, 16.9% in the monthly charts, and 65.9% since August 2024.

Will Ethereum’s Price Gain Steam After The Fed’s Jackson Hole Meeting?

The Jackson Hole Economic Policy Symposium, or simply the Jackson Hole meeting, is an annual meeting organized by the Federal Reserve Bank of Kansas City. This year, the meeting is scheduled to take place from Aug. 21–23, 2025. The meeting is closely watched by investors as it often gives clues about future policy directions. The discussions of the meeting can influence global markets.

Ethereum’s latest price rally comes just ahead of this year’s Jackson Hole meeting. Market participants may be anticipating a dovish stance from the Federal Reserve. There is also a very high chance that the Federal Reserve will cut interest rates by 25 basis points in September. There is a chance that Ethereum’s price will continue to rally into the next month if the Jackson Hole meeting gives bullish cues.

Ethereum’s (ETH) price is currently down by about 11.8% from its all-time high of $4,878.26. There is a high chance that ETH will hit a new all-time high this year. Ethereum’s (ETH) price has rallied to yearly highs this year, following increased ETF inflows over the last few months.

Also Read: Ethereum On Path To Hit $7000: Here’s When

CoinCodex analysts anticipate Ethereum’s price to continue rallying over the next few months.

The platform predicts the asset to hit a new all-time high of $7229.16 on Nov. 17. Hitting $7229.16 from current price levels will entail a rally of about 68.05%.