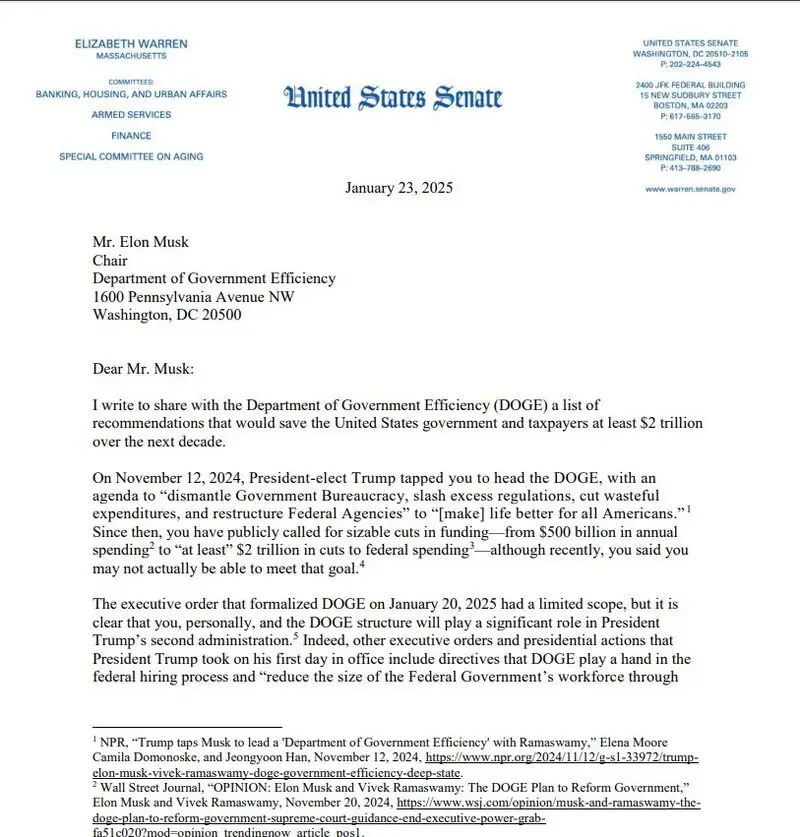

Elizabeth Warren’s crypto initiatives took center stage with a detailed D.O.G.E. proposal to Musk. The letter outlines various approaches to reduce approximately $2 trillion in spending over some years ahead. Between multiple public disagreements about dogecoin and various financial rules, this move marks several key changes. Some aspects of the plan address market volatility while tackling numerous regulatory uncertainties in federal spending. Through several proposed measures, Elizabeth Warren’s crypto policies aim to reshape various sectors.

Also Read: Solana: Can SOL Hit $300 By January-End 2025?

How Elizabeth Warren’s $2 Trillion Plan Could Impact Dogecoin & Market Volatility

Warren’s Progressive Approach to Government Spending

Watch Stagwell’s CEO Mark Penn interview Elon Musk at CES! https://t.co/BO3Z7bbHOZ

— Live (@Live) January 9, 2025

Several key recommendations in Warren’s proposal target some of the tax loopholes and defense contracts. Based on some expert analyses, updating various military contracts could save around $200 billion in cash. The plan aims to balance multiple market stability measures while also protecting the most essential government services. Her approach has implications for Elizabeth Warren’s crypto views as well, particularly in how they might affect market stability.

Warren said:

“Putting Mr. Musk in a position to influence billions of dollars of government contracts and regulatory enforcement without a stringent conflict of interest agreement in place is an invitation for corruption on a scale not seen in our lifetimes.”

Also Read: Official TRUMP & MELANIA Coins Prediction For Early February 2025

Musk’s Response and Historical Tensions

So far, Musk hasn’t responded to several aspects of Warren’s plan. Through various social media exchanges, they’ve clashed over some crypto rules. Meanwhile, numerous members of the dogecoin community watch closely. Elizabeth Warren’s crypto positions have sparked various major debates across several key stakeholder groups. Her recent statements have reshaped numerous aspects of these complex regulatory discussions, introducing multiple new considerations.

DOGE’s Challenging Start

Since January 20, DOGE has faced multiple challenges, including three lawsuits. A few recent statements from Musk to Mark Penn suggest the $2 trillion target might need adjustment. Nevertheless, Elizabeth Warren’s crypto perspectives continue to influence these developments.

In the Wall Street Journal, DOGE co-chairs said:

“We anticipate mass headcount reductions across the federal bureaucracy.”

Conflict of Interest Concerns

Previously, Warren raised some concerns about Musk’s role. Some of the key issues include his Tesla contracts and the wide range of influences over the market’s volatility, particularly in Dogecoin trading. Elizabeth Warren’s crypto critique adds to these concerns, and that’s not surprising to anyone.

Warren’s December letter to President Trump stated:

“He is no ordinary citizen but the CEO of several companies that have significant interests before the federal government.”

Also Read: Nvidia (NVDA) Stock Projected to Grow 70%, Enter $300B Market

Future Implications

Multiple aspects of Warren’s plan could reshape some government-market relationships. Despite various disagreements on crypto rules and dogecoin, several opportunities for collaboration exist. Elizabeth Warren’s crypto initiatives may pave the way for new regulatory frameworks.

Department’s Evolving Priorities

Around DOGE’s evolving direction, some of Warren’s various solutions offer fresh perspectives. The comprehensive approach examines multiple market segments, with several key focuses on crypto spaces where dogecoin maintains a presence. Elizabeth Warren’s crypto policies could influence numerous aspects of these interconnected markets.