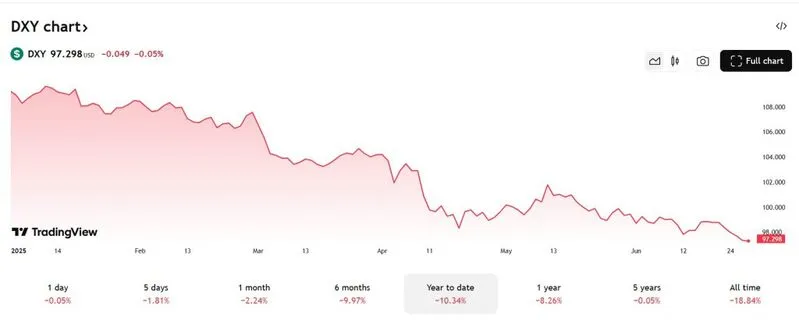

The DXY index, which measures the strength of the US dollar against a basket of six leading currencies is on a relentless decline. It fell to a low of 96 and 97 in June sending warning signals that the US economy is not on the right track. Trump’s trade tariffs were supposed to strengthen the USD but are only causing more harm in the currency markets. Several macroeconomic factors weigh in making the greenback fall to its 3-year low.

Also Read: US Received $88 Billion in Revenue Through Tariffs

One recent factor is the ongoing tussle between Trump and Powell, among many others, that’s pulling it down. The DXY index is at the 97.2 level on Friday and remains 0.07% adding more pressure on the US dollar. So does this signal the end of the greenback and will it be replaced by other currencies in the market? In this article, we will explain what it means to the USD if the DXY index dips in value. It has also dipped more than 10.5% year-to-date.

US Dollar Gets Weaker, DXY Index Falls to 3-Year Low

Francesco Pesole, an FX strategist at ING, explained that the DXY index decline indicates that investors are losing confidence in the US dollar. A banknote runs on trust, which includes easy liquidation, less currency manipulation, and acceptance in all global transactions. While liquidation, acceptance, and no manipulation remain intact, trust and dominance of the USD are slowly being eroded. It is among the intertwines that keep the greenback on the pedestal of the global economy.

Also Read: Global Stocks Have Risen 7% YTD in 2025

“It doesn’t mean it’s going to lose its crown. It doesn’t mean that it’s going to be substituted entirely. The dollar remains the number one currency in most transactions in the world and is still the most liquid one,” Pesole said to CNN. “However, there is now a case for markets to see that dominance sort of starting to decline at a faster pace than it has in recent years,” he summed it up.