An Ethereum (ETH) whale recently deposited 135,284 ETH, worth around $393.4 million, into Gemini after nine years of dormancy. The move may lead to some worry among investors, in case the whale decides to sell and book profits. Let’s discuss what may happen.

Will The Ethereum Whale Sell Its Holdings?

Given the surge in gold and silver prices over the past few months, investors may be shifting their focus away from the cryptocurrency market for the time being. Market participants are most likely adopting a risk-off approach. The Ethereum (ETH) could be following a similar pattern. However, it is also possible that the wallet owner is shuffling their holdings and may not sell their ETH coins.

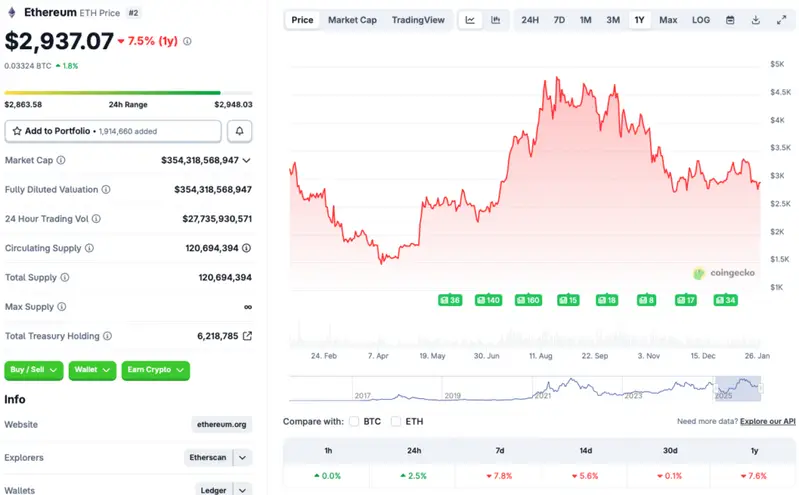

The crypto market has faced substantial losses over the last few months. While January started with some recovery, the market took another hit over the previous few days. According to CoinGecko’s ETH data, Ethereum’s price has recovered 2.5% in the daily charts, but is still red in the other time frames. ETH’s price has dipped 7.8% in the weekly charts, 5.6% in the 14-day charts, and 0.1% over the previous month. The second-largest crypto has also fallen by 7.6% since late January 2025. Ethereum (ETH) is currently struggling to hold $3,000 but has found some support at the $2900 level.

Also Read: Ethereum Tokenization Could Lift Shiba Inu Price

Ethereum (ETH) may not recover until the larger economy improves. Geopolitical tensions, macroeconomic concerns, and slow growth may be deterring investors from taking on riskier assets. ETH hit an all-time high of $4,946.05 in August of last year. However, the asset’s price has fallen by more than 40% since its 2025 peak. Ethereum (ETH) could see some relief if ETF inflows pick up steam and market confidence improves. However, the journey back to $4000 may take longer than what many expect.