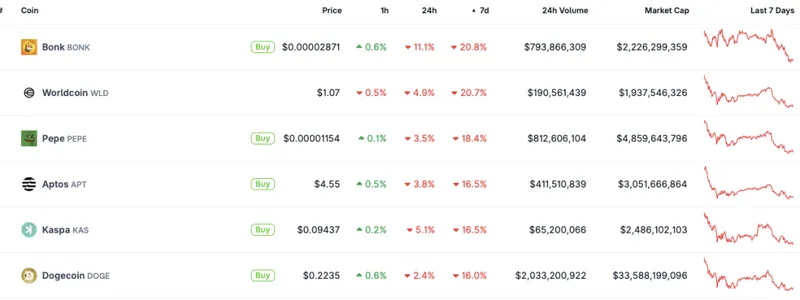

Memecoins seem to be bearing the brunt of the recent market correction. Dogecoin (DOGE), Pepe (PEPE), and Bonk (BONK) have seen a fall of double-digit percentage points over the last week. According to CoinGecko’s DOGE data, it has fallen 16% in the weekly charts, PEPE has fallen 18.4% in the weekly charts, and BONK has fallen by 20.8% in the same time frame. The memecoins have also registered a correction of 2.4%, 3.5%, and 11.1% on the daily charts, respectively.

Should You Buy DOGE, PEPE, BONK During the Dip?

The market correction kicked off earlier this month after a healthy bull run. Bitcoin (BTC), XRP, and BNB climbed to new all-time highs in July. The dip came after increased profit-taking from investors.

Memecoins are subject to heavy speculation. DOGE, PEPE, and BONK are among the most volatile crypto assets. The substantial price decline could be fueled by the upcoming Federal Reserve interest rate announcement. There is a high chance that the Federal Reserve will not cut interest rates yet again. Many anticipate the Fed to keep interest rates the same for another month. High rates may have led to increased liquidations. The move may also bar retail players from actively participating in the crypto market.

Also Read: Dogecoin (DOGE) Enters Bullish Pattern: Traders Forecast $1.5

Buying the dip is a solid investment strategy. However, the crypto market is one of the most volatile markets globally. The markets could swing in any direction over the coming days. In the chance that the Federal Reserve cuts interest rates, DOGE and other crypto assets could enter another bullish phase. Keeping rates unchanged may lead to market consolidation. On the other hand, if the Federal Reserve decides to hike interest rates, Dogecoin (DOGE) and the memecoin sector could see prices fall further. Waiting for the Federal Reserve’s stance before investing might be the way to go.