The US SEC has announced that it will push its decision on the Bitwise Dogecoin ETF and the Grayscale Hedera ETF till November 12 of this year. Bitwise initially filed its S1 application in January, later making amendments in June. The amendments included in-kind creation and redemption features in the proposal. While Bitwise’s DOGE ETF may be delayed, a Bloomberg analyst says another DOGE ETF may be making its debut later this week. Let’s discuss.

Rex-Osprey Dogecoin ETF To Launch On Thursday?

According to Bloomberg ETF analyst Eric Balchunas, Rex-Osprey’s Dogecoin ETF, DOJE, is slated for a Thursday launch. Balchunas stated that he is “Pretty sure this is [the] first-ever US ETF to hold something that has no utility on purpose.“

A spot DOGE ETF may lead to a surge in institutional inflows for the memecoin. Such a development could lead to DOGE’s price hitting a new all-time high. Bitcoin (BTC) and Ethereum (ETH) have hit new peaks thanks to large institutional inflows. A similar pattern may emerge for Dogecoin (DOGE) as well.

DOGE’s Price Movements

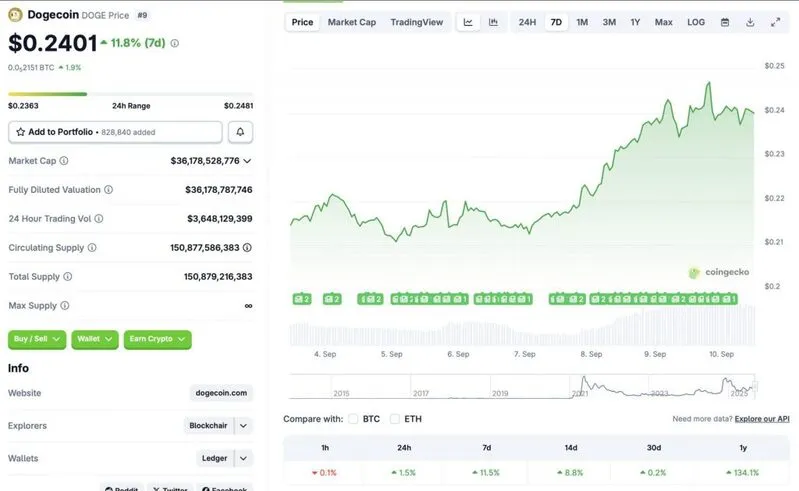

The ETF news may have led to a spike in investor confidence. Dogecoin seems to be trading in the green zone across the board today. According to CoinGecko data, the memecoin is up 1.5% in the daily charts, 11.5% in the weekly charts, 8.8% in the 14-day charts, and 0.2% over the previous month.

Also Read: Dogecoin Forecasted To Reach $1.73 in 2026

Dogecoin’s rally could be due to the ETF news, or it may be triggered by the anticipation of an interest rate cut this month. The Federal Reserve is more than likely to cut interest rates by 25 basis points after its September meeting. A rate cut will likely lead the crypto market to experience another bullish phase. An ETF approval will further boost DOGE’s price.