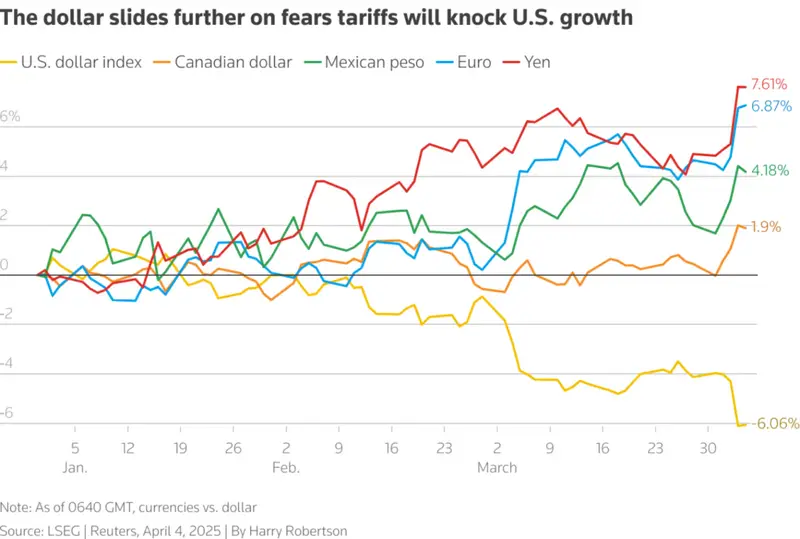

The process of de-dollarization is gaining some anticipated momentum as some foreign banks have decided to dump about $60 billion in U.S. treasuries, while also signaling a major shift in global currency dynamics. This trend reflects growing concerns about the American economy amid tariff policies and debt levels.

Also Read: This $1K Nvidia Investment in 2014 Could’ve Changed Your Life—Here’s Why

Central Bank Gold Buying and the Global Shift From the U.S. Dollar

Central bank gold buying has accelerated as countries seek alternatives to dollar holdings. The de-dollarization process is visible in record gold purchases and U.S. treasury sell-offs.

Gold Becomes the Safe Haven Asset

Gold purchases by central banks have doubled since 2022, reaching over 1,000 tons annually. This de-dollarization strategy reflects diminishing confidence in U.S. economic policies.

Michael Widmer, commodity strategist at BofA, said:

“Emerging market central banks currently hold around 10% of their assets in gold. They should really hold 30% of their assets in gold.”

Foreign Banks Retreat From U.S. Treasuries

The recent de-dollarization trend is also evident in the massive sell-off of U.S. treasuries. Global currency shift patterns suggest this isn’t a temporary thing, no matter how it sounds for the greenback supporters.

Thierry Wizman, global foreign exchange strategist at Macquarie, said:

“What we’re seeing today is a further indication that the structure and nature of the U.S. dollar’s relationship to global markets has changed.”

Also Read: De-Dollarization: 11 Former Soviet States Drop US Dollar in 2025 Shift

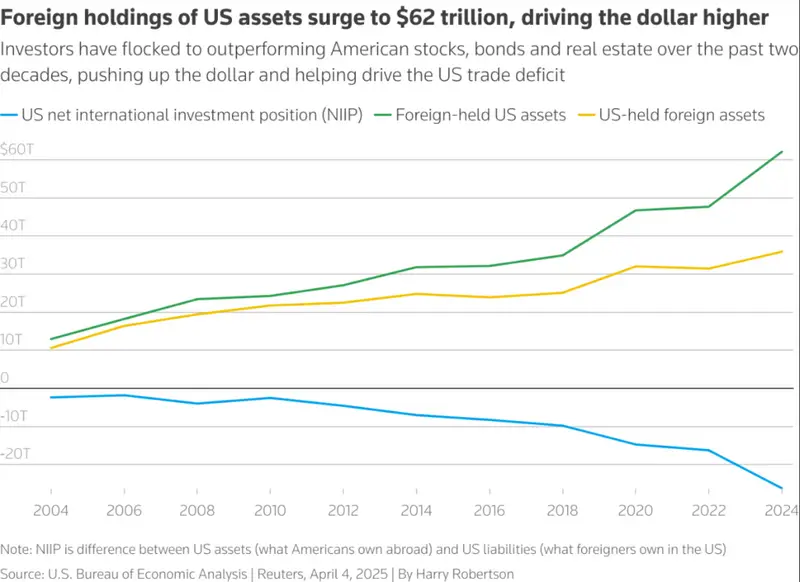

Global Economic Implications

De-dollarization risks include market volatility and potentially higher U.S. interest rates. The global currency shift could fundamentally alter international trade.

Per Jansson, Sweden’s central bank deputy governor, warned:

“If (the dollar’s status) would change, that would be a big change for the world economy… and would basically create a mess.”

Antonio Fatas, macroeconomist at INSEAD business school, cautioned:

“This erratic behavior is too risky. This is such an inflexion point for the role of the U.S. The problem is that we don’t have an alternative to the dollar – and that is why this is going to be painful.”

Also Read: New Country Begins Ditching US Dollar, Accumulates Gold in Central Bank

The de-dollarization movement continues to gain momentum through central bank gold buying and U.S. treasury sell-offs, reshaping the future of global finance.