Palantir stock surged 8.2% following a $795 million U.S. Army contract modification announcement, and Wedbush analyst Daniel Ives is reiterating his buy rating along with a $140 price target. The deal brings total Army contract value to around $1.3 billion, which also marks Palantir stock’s first billion-dollar milestone and is driving immediate investor enthusiasm for the AI defense specialist right now.

Also Read: Nvidia Rewires H20 Chip to Bypass China Ban: NVDA Stock Set to Rebound?

Unlock Palantir Stock Price Prediction And Market Volatility Amid Regulatory Risks

Palantir Stock Surges on Historic Army Deal

Palantir stock jumped 8.2% to $25.67 per share on May 21, 2025, and this came after securing the $795 million contract modification for Maven Smart System software. Trading volume also spiked to 42.3 million shares compared to the 30-day average of 29.5 million, which is reflecting strong investor confidence in Palantir stock’s defense positioning at the time of writing.

Daniel Ives from Wedbush stated:

“We believe this deal represents an additional tailwind for PLTR with AI initiatives across the US government accelerating with AI a strategic focus on the federal front and Palantir in essence in the sweet spot to benefit from a tidal wave of federal spending on AI across North America and Europe.”

Golden Dome Project Fuels Palantir Stock Rally

President Trump’s $175 billion Golden Dome missile defense initiative is also adding momentum to the Palantir stock surge right now. The project includes $25 billion earmarked for 2026, and Palantir is positioned to provide AI analytics for the satellite-based defense system, which further supports PLTR assets upward trajectory.

Ives had this to say:

“It is highly expected that Palantir will be one of the main providers and beneficiaries as the stepped-up AI investments now being seen under the Trump Administration have and will continue to benefit Palantir within the Beltway.”

Also Read: Apple (AAPL) Stock Jumps 24% on US-China Deal Despite “All Eggs in One Basket”

Market Volatility Can’t Stop PLTR Stock Momentum

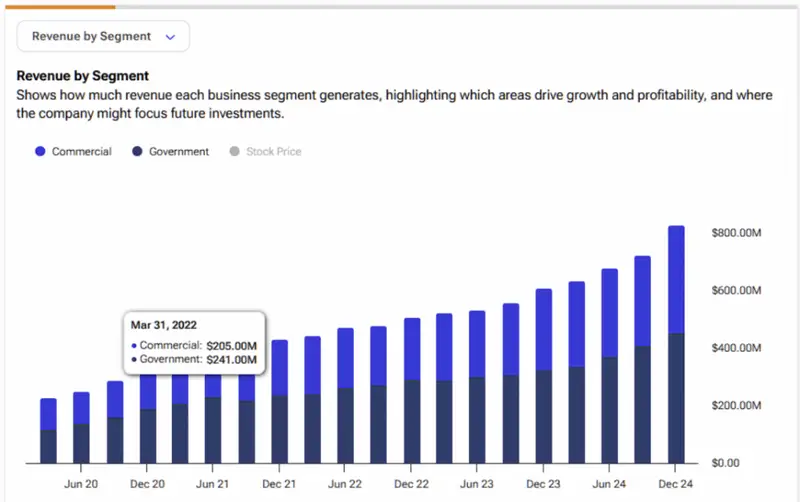

Despite broader market volatility affecting tech stocks, Palantir stock has also rallied 60% year-to-date, and it’s significantly outperforming indices. The company’s government-focused AI approach helps it navigate market volatility while also benefiting from increased federal AI spending, with PLTR stock maintaining its upward momentum right now.

Market volatility concerns haven’t dampened Palantir stock performance, and the recent Army deal is providing concrete validation of its growth strategy. While Nasdaq: NVDA along with other AI stocks face market volatility headwinds, PLTR stock benefits from stable government contract revenue streams.

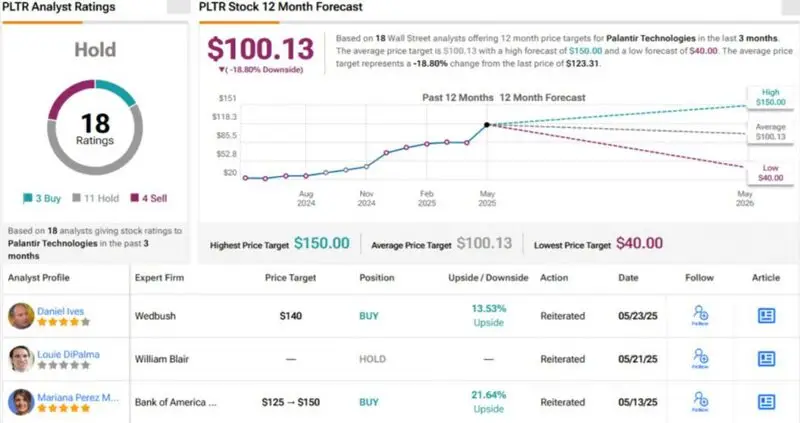

Bullish Price Prediction Despite Mixed Sentiment

Wedbush maintains its aggressive $140 PLTR price prediction, which represents upside from current levels following the stock surge. However, broader Wall Street shows mixed sentiment, and the average Palantir price prediction of $100.13 suggests more conservative expectations despite recent Palantir stock gains at the time of writing.

Ives stated:

“Palantir remains one of our top names to own in 2025 and this deal represents another opportunity for PLTR to capitalize on while continuing to generate unprecedented traction for its entire portfolio across in the federal and commercial landscapes.”

The subscription-based defense model also supports bullish Palantir price prediction targets, providing recurring revenue stability that justifies premium valuations despite ongoing market volatility challenges.

Also Read: Warren Buffett’s $330B Portfolio Holds 58% in Just 4 Power Stocks