Apple stock price prediction seems quite positive right now as the well-known analyst Dan Ives continues to forecast that AAPL, MSFT, and also PLTR will probably surge despite the ongoing market volatility we’re seeing. Various tech stocks, such as NVDA and TSLA, are still facing somewhat uncertain Nasdaq trends, yet Ives apparently remains rather bullish on these select companies heading into 2025.

Also Read: Ripple’s XRP ETF Goes Live: Can Price Hit $2.50 Before June?

Tracking Apple, Microsoft & Palantir Stocks Amid Market Volatility and Nasdaq Trends

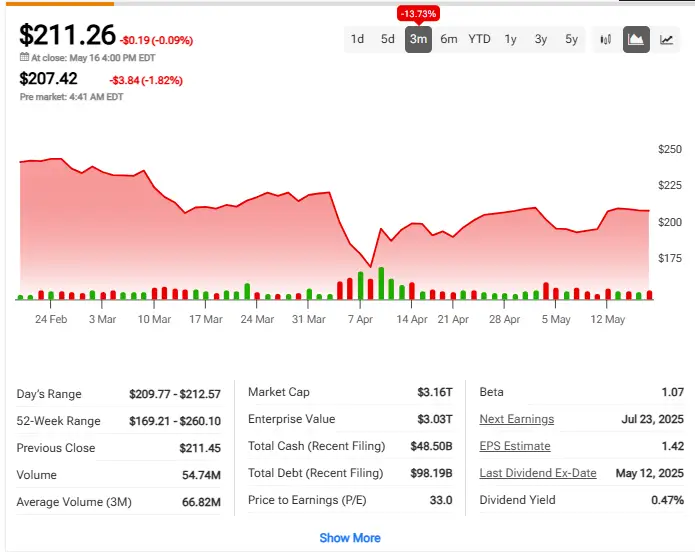

1. Apple’s Path to $210 – Bullish Case Emerges

The latest Apple stock price prediction from Wedbush’s Dan Ives actually suggests that AAPL could potentially reach around $210 within a year or so. While writing this, Bitcoin was worth over $200 which could suggest that those writing about it were unconcerned by the recent drops in the Nasdaq index.

Dan Ives stated:

“The bull case is back on the table for Apple as iPhone 16 initial builds look robust with our Asia checks positive.”

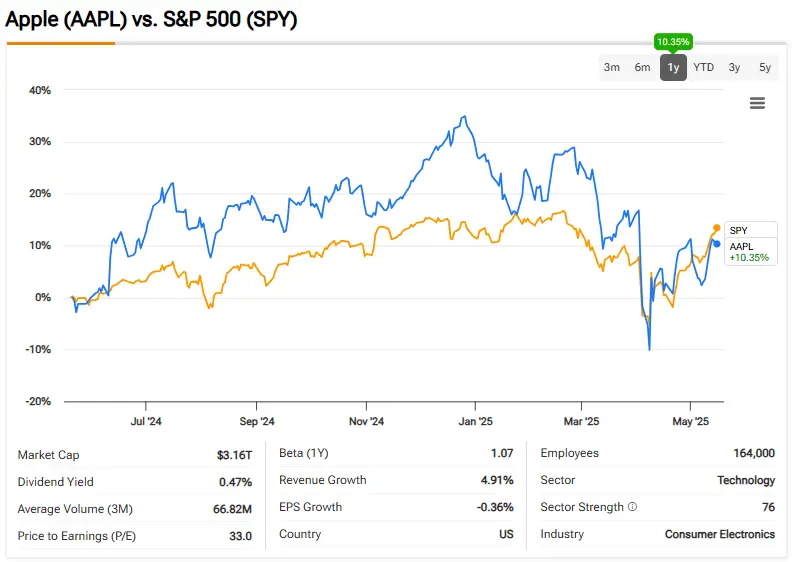

Wall Street generally seems to support this particular Apple stock price prediction with an average target of about $228.65, which is honestly surpassing even Ives’ forecast in some ways. AAPL continues to outperform the S&P 500 index despite NVDA essentially stealing many headlines in the tech sector lately.

Also Read: Shiba Inu: Just $55 Invested in SHIB Becomes $1 Million Today

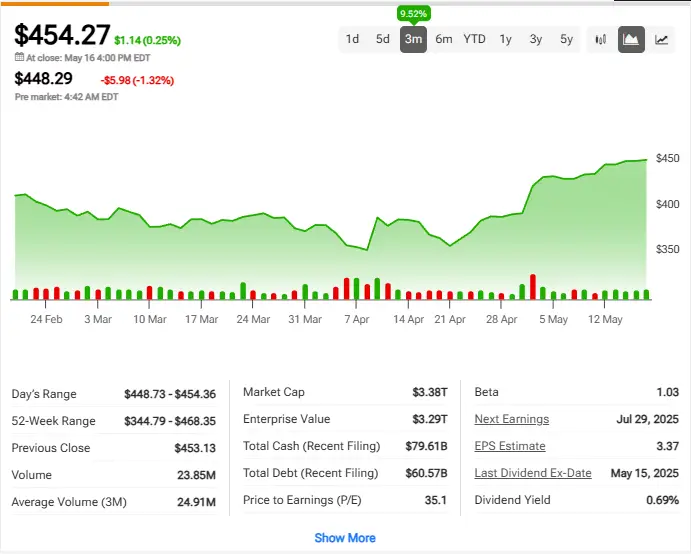

2. Microsoft’s $400 Target Amid AI Push

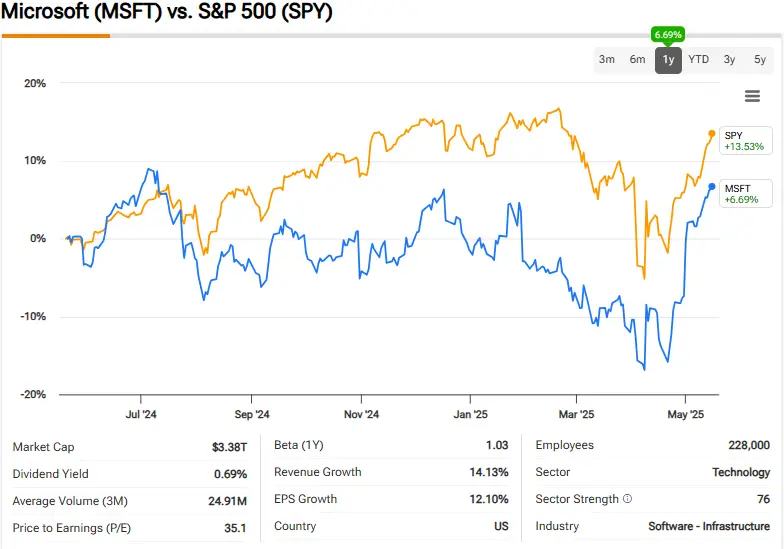

Microsoft‘s trajectory kind of mirrors the broader tech market volatility in recent months, yet MSFT currently holds somewhat stronger analyst sentiment than AAPL with approximately 35 “Strong Buy” ratings from various experts.

While TSLA has definitely struggled with consistency this year, MSFT continues making steady progress toward Ives’ rather ambitious $400 target, mostly fueled by its ongoing AI advancement and also its impressive cloud expansion efforts.

Also Read: Dogecoin: AI Sets DOGE Price For May 25

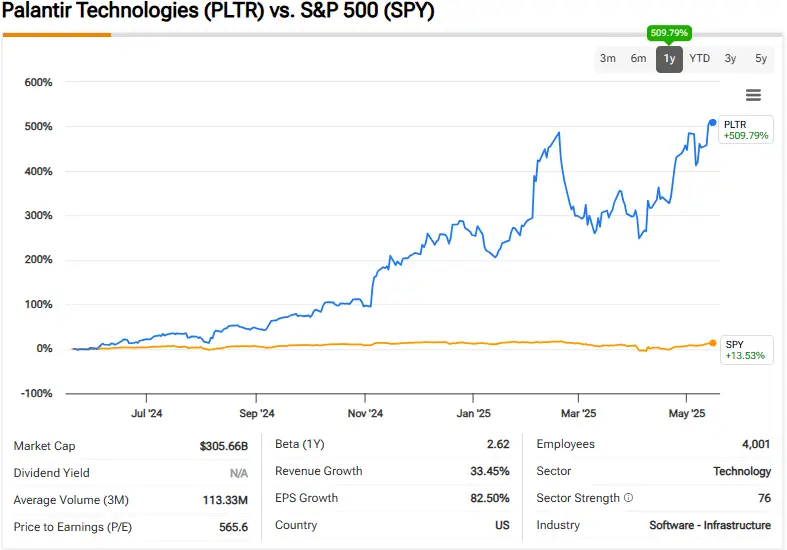

3. Palantir’s Controversial $18 Target

Palantir presents perhaps the most divisive Apple stock price prediction comparison right now, with PLTR showing really massive 509% yearly gains while most analysts still remain somewhat cautious about its future prospects.

Even though NVDA and TSLA have experienced volatile markets recently, Palantir’s recent performance could be one of the reasons Ives has given a somewhat higher target.

Also Read: XRP Rich List Just Got Pricier: Here’s What It Now Takes to Qualify

Models used to predict Apple stock prices consider the strength of the United States dollar, the local currency and the strong correlations being seen in Ripple and Bitcoin markets these days.