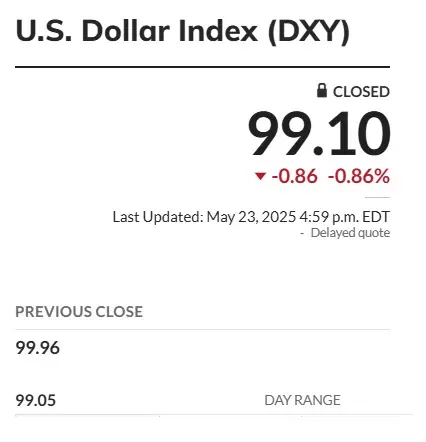

There is no respite for the US dollar in the currency markets as the DXY index is only heading south. The DXY index, which measures the performance of the US dollar is now at the 99 level. It briefly touched 100 early this month but failed to hold on to its resistance level. The greenback has never been this weak for 12 years and is only losing steam against local currencies.

Also Read: Warren Buffett’s $330B Portfolio Holds 58% in Just 4 Power Stocks

Leading local currencies are having an upper hand in the forex markets and racing ahead of the USD. The US dollar had touched a high of 109.40 this year but quickly slipped below the 100 level in the currency markets. Federal Reserve Governor Christopher Waller said to Fox Business that reducing tariffs to 10% could push the markets on the right track.

“If we can get the tariffs down close to the 10% and then that’s all sealed, done, and delivered somewhere by July, then we’re in good shape for the second half of the year,” said Waller. “Then we’re in a good position to kind of move with rate cuts through the second half of the year.” If Trump continues with the tariffs, the US dollar could lose further steam in the currency markets.

Also Read: US Power And Dollar Dominance: Cause & Consequence Intertwined

Currency: Not US Dollar, Asian-based Financial Assets See an Influx of Investments

The investments in the US dollar have declined while Asian-based financial assets experienced an influx of funds. Trump’s tariffs and trade wars have tipped the markets towards other countries that are now more lucrative for investments. The US dollar is caught in the crosshairs of tariffs and is weakening in the currency sector.

Also Read: Ripple Prediction: XRP Price For End of May, 2025

Global investments in China have seen a major uptick and investors take an entry position in the Asian markets. Read here to know the latest prediction on the US dollar’s prospects in the currency markets provided by BlackRock.