The Kenyan shilling briefly outperformed the US dollar on Tuesday, according to the latest data from the London Stock Exchange. At 07:09 GMT, the shilling traded at 128.80/129.40, compared with Monday’s closing rate of 129.00/50. The US dollar is being outperformed by leading local currencies this year as trade wars and tariffs take center stage. Bloomberg reported early this year that the USD was trounced by eight out of nine leading global currencies this year.

Also Read: Could $500 in Pi Coin Today Make You Rich by 2030?

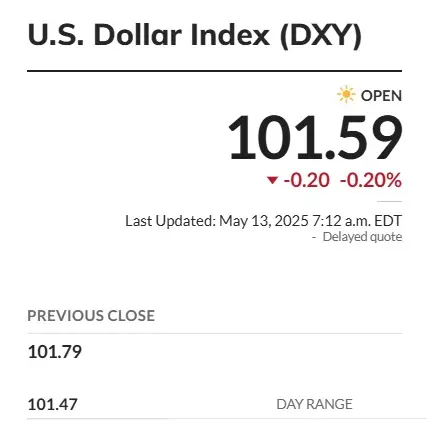

On Friday’s trading session, the Kenyan shilling came out on top of the US dollar in the currency markets. This is the second time the local currency has beaten the USD in three trading sessions. The dip comes after the DXY index fell to the 101.5 mark after moving ahead from 99 to 101 this month.

Also Read: Musk’s D.O.G.E Disaster: How $1K in Dogecoin (DOGE) Got Rekt

Currency: Kenyan Shilling & the US Dollar

The Kenyan shilling is displaying more stability than the US dollar in the currency market this month. Traders are closely monitoring the development and might consider taking an entry position in the local currency. If the greenback begins to decline back to the 98-98 range, the shilling will deliver decent profits.

Also Read: WonderFi To Be Acquired for $250M as Robinhood Eyes Global Crypto Domination

As of May 2025, the USD has dipped nearly 8.4% against a basket of major global currencies. It is now much weaker than it was a year ago, indicating that the room for a decline is stronger. Several factors have led to its dip, including trade wars, tariffs, and monetary policies. The advantage of the Kenyan shilling against the US dollar is that the country’s inflation is comparatively lower.

In addition, their purchasing power remains stable while Americans are finding it hard to cope with rising prices, as wages are not catching up. There is no arguing that the US dollar is far superior to the Kenyan shilling, and the recent upward trajectory is only temporary. It won’t take much time for the USD to reclaim its top spot in the global forex markets.