The Indian rupee has fallen to a new all-time low against the US dollar in the currency market this month. The dip comes after Trump won the election propelled the USD to climb in the indices. The DXY index, which tracks the performance of the US dollar shows the currency trading at the 106.10 mark on Wednesday. It has sustainably scaled up in the charts where it dipped to a low of 101.90 in August this year.

Also Read: De-Dollarization: Russia-India Trade Nears $90 Billion & 90% Dollar-Free

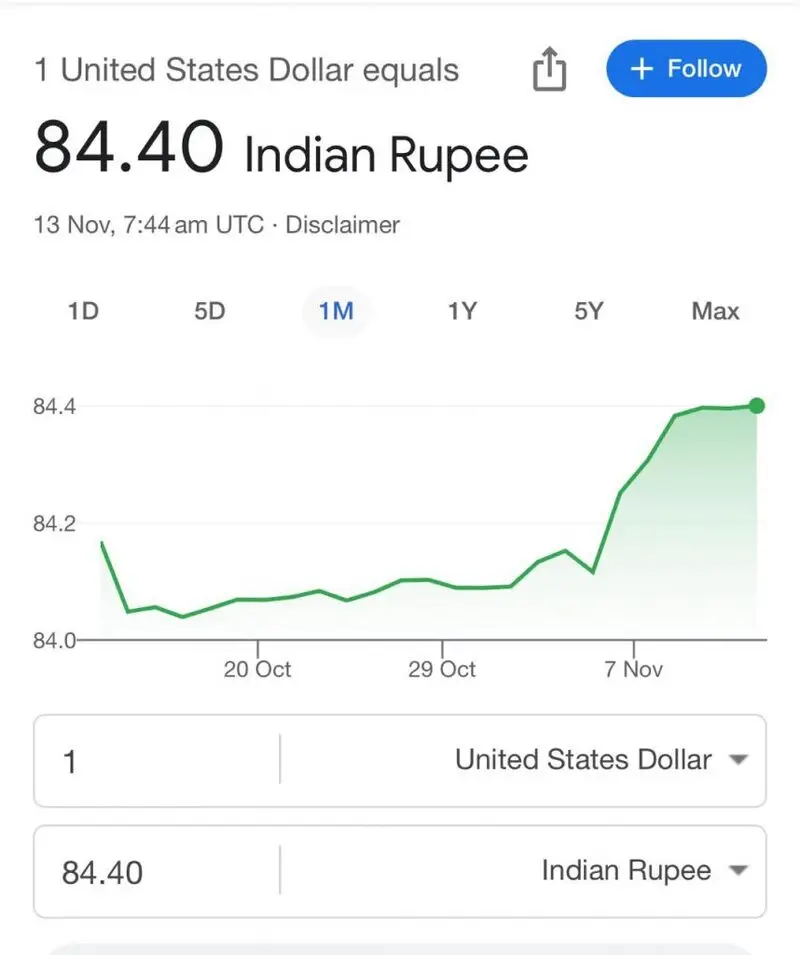

The strengthening of the US dollar is making the Indian rupee weaker in the currency sector. The rupee has fallen to a low of 84.40 on Wednesday and is attracting bearish sentiments in the forex markets. The development is worrisome in the Indian market as day-to-day essentials could soar as the currency dips.

Also Read: Russia’s Gold Reserves Hit $207.7B: A De-Dollarization Strategy?

Currency: Why is the Indian Rupee Falling Against the US Dollar?

The stock market is facing an exodus from foreign institutional investors which is making the Sensex and Nifty dip. In the last two months alone, the Indian markets saw an outflow of nearly $1.2 billion from foreign funds. This is making the rupee come under tremendous pressure from the US dollar this month.

Also Read: “Re-Dollarization” Trends Dubbing De-Dollarization A Sad Myth

The outflow of funds has led to a slow crash in the Indian stock market. While the Sensex was at 85,000 in September, it is now at 77,600. That’s a steep decline of 7,000 points, with a dip of nearly 8% in just two months. The Indian rupee could find it harder to sustain if the US dollar rises further in the indices.

Investors sold equities from the Indian market when the index reached its peak. The sell-off was then put into the US bonds, which also delivered gains. Therefore, the Indian rupee could lose more value, and the US dollar could strengthen further. “The primary reason for the sustained selling was the sharp spike in US bond yields, which took the 10-year yield to a 17-year high of 5% on 19th October, ” said V.K Vijayakumar, Chief Investment Strategist at Geojit Financial Services.