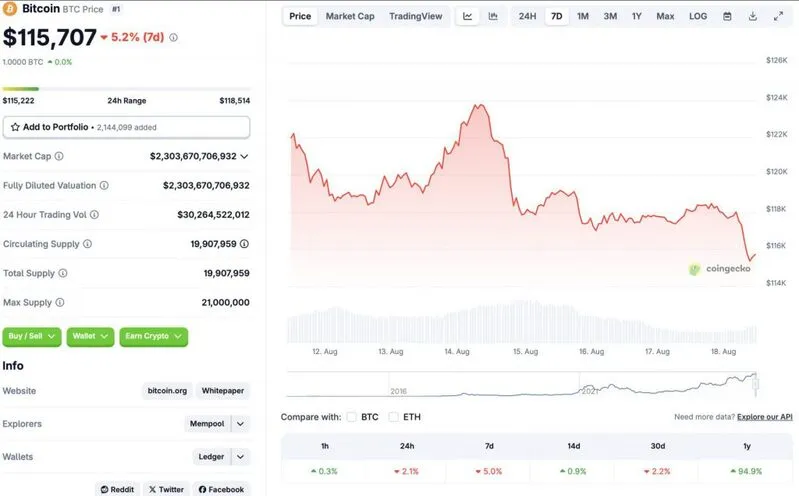

The cryptocurrency market is facing another steep correction after its recent rally. According to CoinGecko data, Bitcoin (BTC) has fallen to the $115,000 price level. The asset is down 2.1% in the daily charts, 5% in the weekly charts, and 2.2% over the previous month. BTC has maintained some gains in the 14-day and yearly charts, rallying 0.9% and 94.9%, respectively. Let’s discuss why the cryptocurrency market is facing another crash right now.

Why is The Cryptocurrency Market Facing Another Crash?

The market correction began on Aug. 14, after the Bureau of Labor Statistics revealed higher-than-expected producer price index (PPI) numbers. PPI rose by 0.9% on the month, while Dow Jones expected an increase of 0.2%. The figure measures the final demand goods and services prices. The increase represents the most significant jump since June 2022. The development has likely spooked investors away from risky markets, such as cryptocurrencies. The high PPI figure could lead the Federal Reserve to reconsider cutting interest rates in September.

The spike in PPI numbers comes right after better-than-expected consumer price index (CPI) numbers. The low CPI figures led to the cryptocurrency market taking off. Bitcoin (BTC) climbed to a new all-time high of $124,128 on Aug. 14. However, the PPI data led to the market losing substantial steam.

Also Read: Bitcoin Overtakes Google’s Market Cap as BTC Hits New Peak

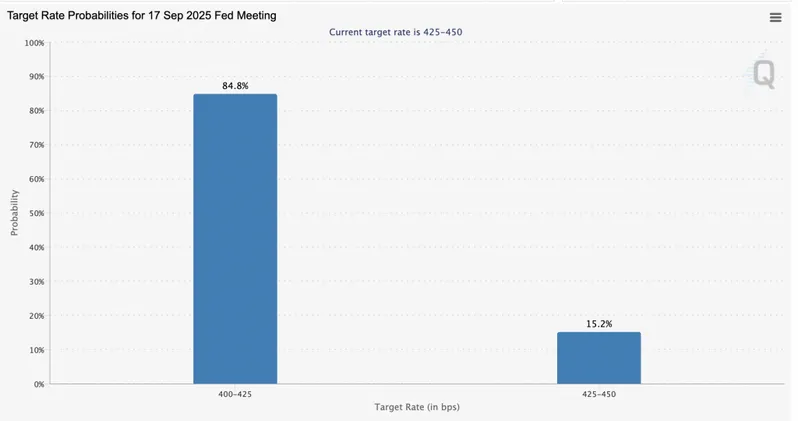

The Federal Reserve will meet at Jackson Hole later this month. The Federal Reserve will likely discuss its stance on the US monetary policy at the meeting. The high PPI figures could be a cause for worry. However, the low CPI figures could provide some cushioning. According to the CME Fedwatch tool, there is an 84.8% chance that the Federal Reserve will cut interest rates by 25 basis points next month. A rate cut could lead to the market picking up steam once again.