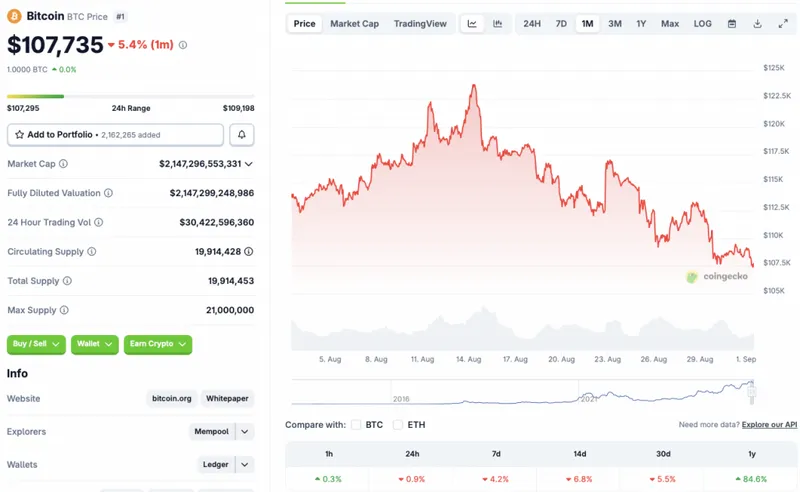

The cryptocurrency market continues its downward trajectory as we enter September. CoinCodex’s statistics note that Bitcoin’s (BTC) price has fallen to the $107,000 level, after hitting an all-time high of $124,128 on Aug. 14. BTC’s price has dipped 0.9% in the daily charts, 4.2% in the weekly charts, 6.8% in the 14-day charts, and 5.5% over the previous month.

Why Is Bitcoin’s Price Falling?

The latest market price crash was triggered after a lower-than-anticipated producer price index (PPI) figure for July. The market picked up steam after Federal Reserve Chair Jerome Powell delivered a dovish speech after the Jackson Hole meeting. The market seems to have taken another dive over the last weekend.

The correction may have also been triggered by increased profit-taking after Bitcoin (BTC) climbed to an all-time high. Apart from BTC, Ethereum (ETH), XRP, and BNB also hit new all-time highs over the last few weeks.

September has historically been a bearish month for Bitcoin (BTC). BTC has usually seen a post-summer price pullback. We could be following a similar pattern in 2025 as well.

Will The Market Recover?

There is a very high chance that the Federal Reserve will cut interest rates by 25 basis points in September. A rate cut often leads to investors taking on more risks. The move could lead to a surge in Bitcoin investments, thereby causing a market-wide resurgence.

Many financial institutions anticipate the Federal Reserve to cut interest rates by a total of 75 basis points by the end of this year. A 75 basis point interest rate dip will likely lead to a big surge in Bitcoin and cryptocurrency investments.

While September has been a bearish month for Bitcoin (BTC), the asset will likely pick up steam by the fourth quarter of this year. ETF inflows are expected to continue, and many investors may follow the buy-the-dip strategy. Both developments could further aid Bitcoin’s price.