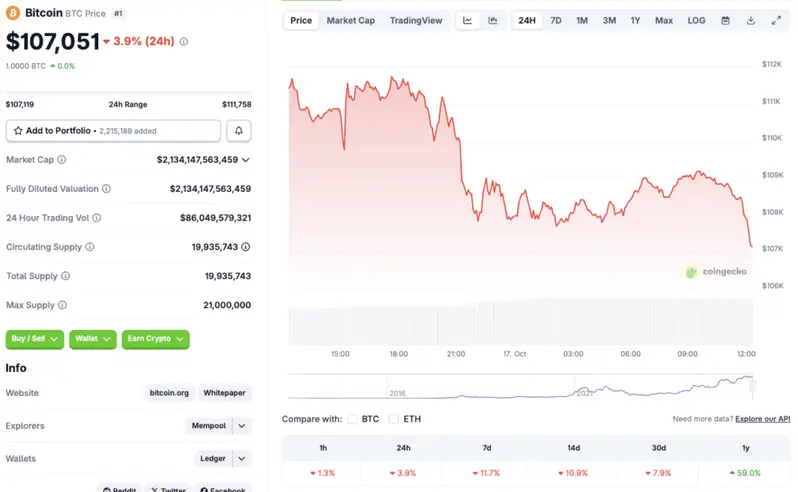

The crypto market crash seems to be deepening. CoinGecko data shows that Bitcoin’s (BTC) price has fallen to the $107,000 price level, and the global market cap has dipped 4.4% in the last 24 hours to $3.72 trillion. BTC is barely holding on to the $107k price point. The original cryptocurrency’s trajectory will determine where the larger market goes. CoinGecko highlights that BTC’s price has fallen 3.9% in the last 24 hours, 11.7% in the last week, 10.9% in the 14-day charts, and 7.9% over the previous month. Let’s discuss if Bitcoin’s (BTC) price faces a threat of falling below the $100,000 price level.

Will the Market Crash Pull Bitcoin Below $100,000?

The latest market crash has been one of the most significant corrections in crypto history. The dip was likely triggered by trade disputes between the US and China. While there was a slight recovery, the rally did not last. According to CoinGlass data, the crypto market has seen more than $700 million worth of liquidations in the last 24 hours.

Investor sentiment is also quite low, amid high volatility. Market participants are likely taking a risk-averse strategy. This behavior is reflected in gold prices hitting record highs. Investors seem to be putting their money in safe havens to escape the ongoing volatility. Bitcoin (BTC) and other cryptocurrencies, being risky bets, are facing the brunt of the development.

If the market continues its current trajectory, Bitcoin (BTC) could lose the $100,000 level. However, there is a high chance that the Federal Reserve will roll out another interest rate cut later this month. Another rate cut could provide some cushioning to any possible price crashes.

Also Read: Public Firms Holding Bitcoin Increase By 40%: $117 Billion Held

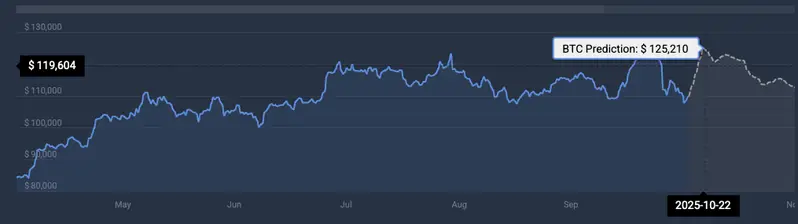

According to CoinCodex’s BTC analysis, Bitcoin will breakout over the coming weeks. The platform anticipates the asset to hit $125,210 on Oct. 22.