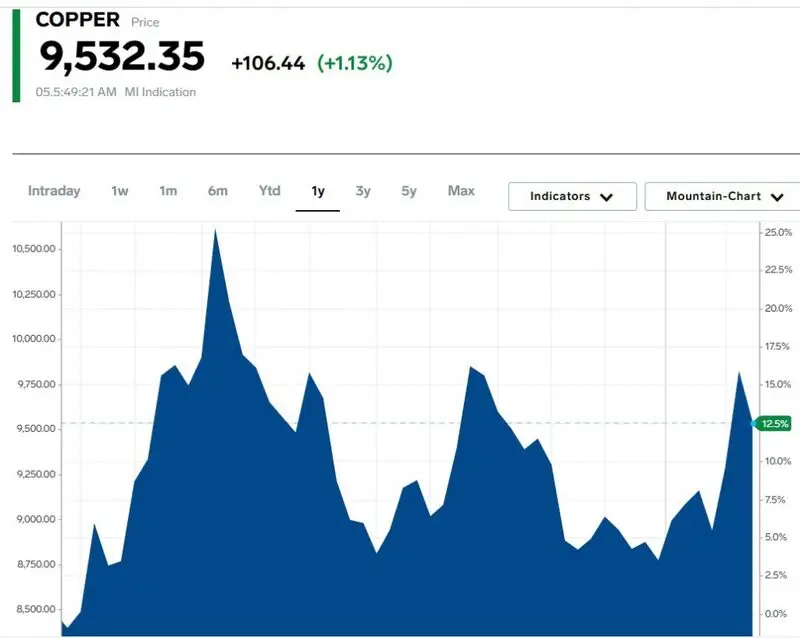

Copper prices have soared more than 100 points on Thursday’s trading and spiked nearly 1.2%. It breached the $9,500 mark and is hovering around the $9,532 price range. The rebound in price comes after China’s President Xi Jinping vowed to protect the metal industry from tariffs imposed by Trump. China also imposed reciprocal tariffs on some U.S. goods escalating the trade war and causing volatility in the commodity markets.

Also Read: XRP Surges 7% As Brazil Will Launch World’s First Spot ETF

Traders assessed the impact of reciprocal tariffs that led to a change in the market sentiment for copper prices. Jinping’s pledge to support the private sector encouraged businesses to regain confidence in the nation’s economic model. For the uninitiated, China is the fourth largest producer of copper boasting a production capacity of 1,700 tons a year. The U.S. is a distant behind in producing 1,100 tons of the industry-grade metal.

Also Read: Stock Market Volatility Increases as Fed Holds Ferm on Interest Rates

Copper Prices Predicted To Reach $10,000

The National Development and Reform Commission (NDRC) in China announced plans to ease constraints on private enterprises, reinforcing government support. This brought back enthusiasm in the metal sector making copper prices head north on Thursday. With strong government support and a large manufacturing and global distribution unit, China is in control of the copper market. Tariffs on products that China dominates could eventually prove costly to the Trump administration.

Also Read: Dogecoin (DOGE) On Path To Surge 234%To Hit $0.84: Here’s When

Copper prices were mostly trading sideways this year with little to no price spurts in the charts. Trump’s tariffs contained its price as investors remained wary of taking an entry position fearing losses. China’s reassurance of protecting the industry with reciprocal tariffs brought in confidence among commodity investors. This led to copper zooming ahead in the charts and could continue the positive momentum this week.

The upward momentum is most likely to continue into next week making copper prices breach the $10,000 mark. It last dipped below $10,000 in May 2024 and could reclaim its lost territory in February this year.