2025 belonged to silver and gold, with their winning streak entering 2026 with confidence. In the middle of this, copper has also debuted on charts, marking its high price margins on the market radar. With the copper shortage crisis looming over, the metal is now jumping hoops at a time and may end up scaling a new high soon. How high can copper truly jump? Here’s the latest copper price prediction for 5 years.

Also Read: Gold Price Prediction For The Next 5 Years

Copper Shortage: What’s That About?

Copper price has now started to scale, primarily due to its shortage crisis scaring industries. The metal is a core element backing multiple industries, used as a primary source and a catalyst fueling EV production and the electrical domain. The metal shortage is a significant crisis to consider, as the metal powers multiple industries at once.

“The future is not just copper-intensive; it is copper-enabled. Every new building, every line of digital code, every renewable megawatt, every new car, and every advanced weapon system depends on the metal,” Aurian De La Noue, executive director for critical minerals and energy transition consulting at S&P Global Energy, said in a statement.

Copper mines take years to produce the metal. On average, it takes 17 years for a fresh mine to yield copper, pressuring the world to consider its copper usage and analyze its demand.

Copper Price Prediction for the Next 5 Years

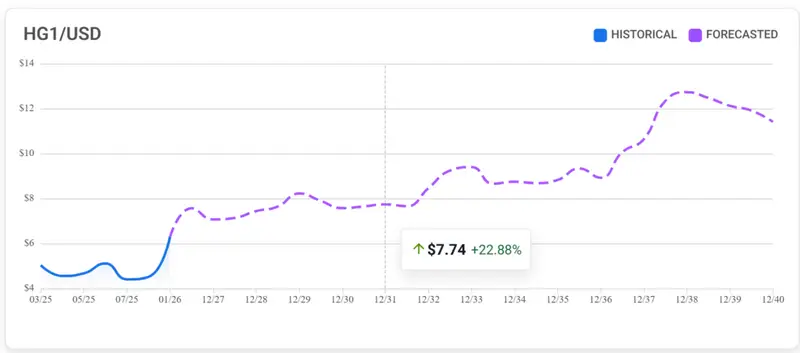

According to Traders Union, copper price predictions for the next 5 years include the metal hitting $8+ around 2031. The metal may peak around 2038, exploring at $12+ price levels.

Also Read: Analyst Warns: Safe-Haven Trades May Reverse as “New Winners” Emerge