Congress stock picks are getting a lot of attention right now, especially as more and more elected officials seem to be investing in tech and biotech companies. Recent data actually shows that members are betting big on NVDA (NVIDIA), AVGO (Broadcom), and AMGN (Amgen) – and these congress stock picks have been delivering some pretty impressive returns. At the time of writing, these political stock strategies have consistently outperformed the broader market, which is why many retail investors are keeping an eye on government investments for potential guidance.

Also Read: Ripple: How High Will XRP Rise In Q2 2025?

Find Out Which 3 Stocks Congress Members Are Betting Big On

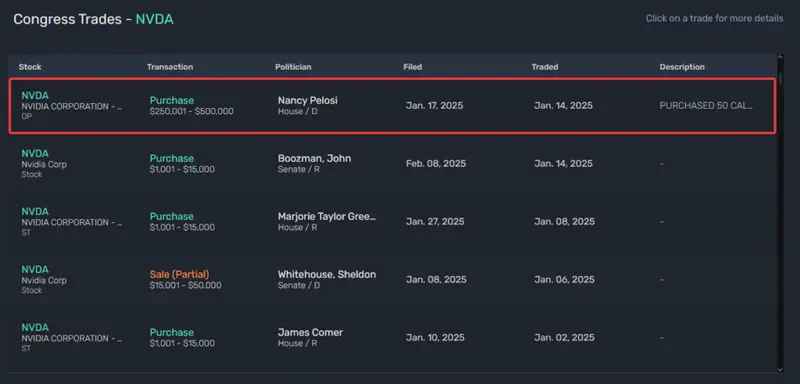

1. NVDA: AI Computing Giant

NVIDIA is currently leading the congress stock picks with its dramatic growth from near-zero to over $140 by early 2025. Nancy Pelosi, for instance, invested between $250,001 and $500,000 in 50 NVDA call options with an $80 strike price that will expire in January 2026. Also, representatives such as Marjorie Taylor Greene and Senator John Boozman made smaller purchases in the $1,001-$15,000 range.

Also Read: Ethereum Price Prediction: $4,315 by 2025 – Could the Pectra Upgrade Fuel the Surge?

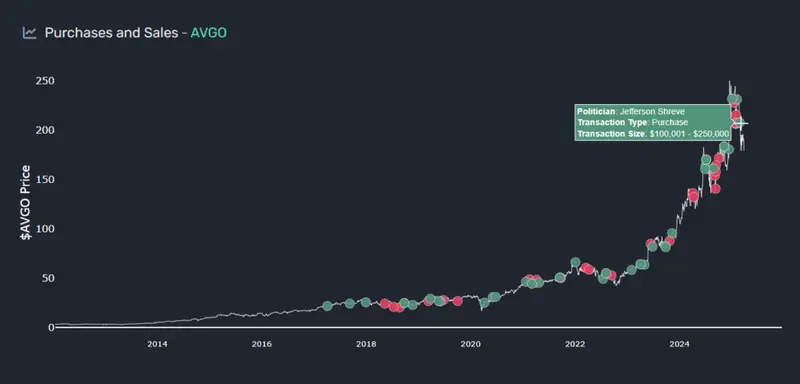

2. AVGO: Semiconductor Leader

Broadcom is also ranking pretty high among congress stock picks, and has grown from around $20 to over $230 in just about a decade. Pelosi’s million-dollar options purchase stands out as the largest congressional investment across these stocks. Additionally, Jefferson Shreve invested between $100,001-$250,000 while several other representatives made smaller trades as well.

Also Read: Trump Poised to Repeal IRS DeFi Tax Rule After Senate’s 70-28 Vote

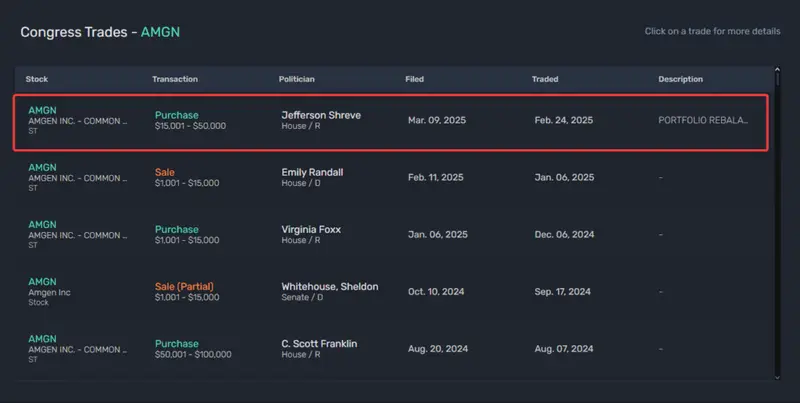

3. AMGN: Steady Biotech Performer

Amgen completes the top congress stock picks, and has been rising steadily from about $70 to over $300. Jefferson Shreve purchased around $15,001-$50,000 worth on February 24, 2025, and C. Scott Franklin invested between $50,001-$100,000 back in August 2024. These government investments have generally, for the most part, outperformed the broader market.

Cross-Party Investment Patterns

It looks like both Democrats and Republicans seem to favor these stocks, with their political stock strategies showing some really remarkable timing before price increases. Nancy Pelosi’s investments definitely stand out, though many legislators from both parties are maintaining positions in these companies too.

Also Read: Dogecoin: Elon Musk’s Grok AI Answers If X Will Integrate DOGE

The performance of these congress stock picks kind of suggests that elected officials may have some valuable market insights, whether from their committee work or just general economic forecasting. So, investors who are watching government investments closely might want to keep NVDA, AVGO, and AMGN on their watchlists, just saying.