New research from top US-based crypto exchange platform Coinbase reveals the crypto markets are signaling a potential rotation from Bitcoin (BTC) to altcoins.

In its new monthly outlook newsletter, Coinbase says Bitcoin’s market dominance is waning, an early signal that investors are about to rotate to altcoins, a move predicted to happen by September.

“Bitcoin’s market dominance has declined from 65% in May 2025 to approximately 59% by August 2025, signaling the early stages of capital rotation into altcoins.

CoinMarketCap’s Altcoin Season Index currently sits in the low 40s, well below the 75 threshold by which they historically define alt seasons, even though the altcoin market cap has climbed over 50% since early July to $1 trillion as of August 12.

We think that current market conditions have started to signal a potential rotation into a full-scale altcoin season as we head into September.”

Data from TradingView reveals Bitcoin’s dominance level (BTC.D) – which keeps track of what percentage of the total market cap of crypto belongs to BTC – is sitting at 59.90% at time of writing.

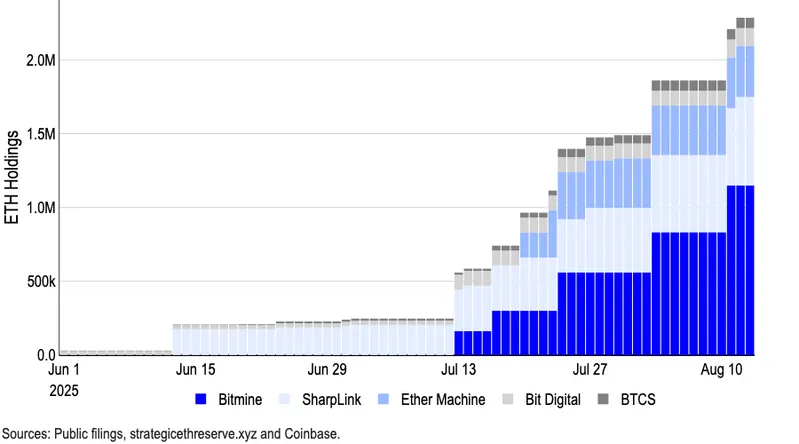

Moving on, Coinbase notes that institutional activity surrounding Ethereum (ETH), the second-largest digital asset by market cap, is on the rise.

“Meanwhile, the divergence in the Altcoin Season Index vs the total altcoin market cap largely reflects the increasing institutional interest in Ethereum, supported by demand from digital asset treasuries (DATs) and the growing narrative around stablecoins and real-world assets.

Just Bitmine Immersion Technologies alone has bought 1.15 million ETH with a new raise of $20 billion that gives it total capacity to buy $24.5 billion worth of ETH. (The former leader of ETH DATs, Sharplink Gaming, now holds around 598,800 ETH).”

Bitcoin is trading for $117,388 at time of writing, a fractional decrease on the day, while ETH is valued at $4,485.

Follow us on X, Facebook and Telegram