Coinbase Institutional says a rough November may have created a strong setup heading into the end of the year.

The firm says open interest across Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) perpetual futures has fallen 16% month over month.

In addition, US spot Bitcoin ETFs (exchange-traded funds) saw $3.5 billion in outflows and spot Ethereum ETFs recorded $1.4 billion in redemptions, reflecting broad risk reduction.

Meanwhile, Bitcoin perpetual funding rates also dropped two standard deviations below their 90-day average before stabilizing.

“A rocky November may have set the stage for a December to remember…

So…why the cautious optimism? Because speculative excess has been flushed out.

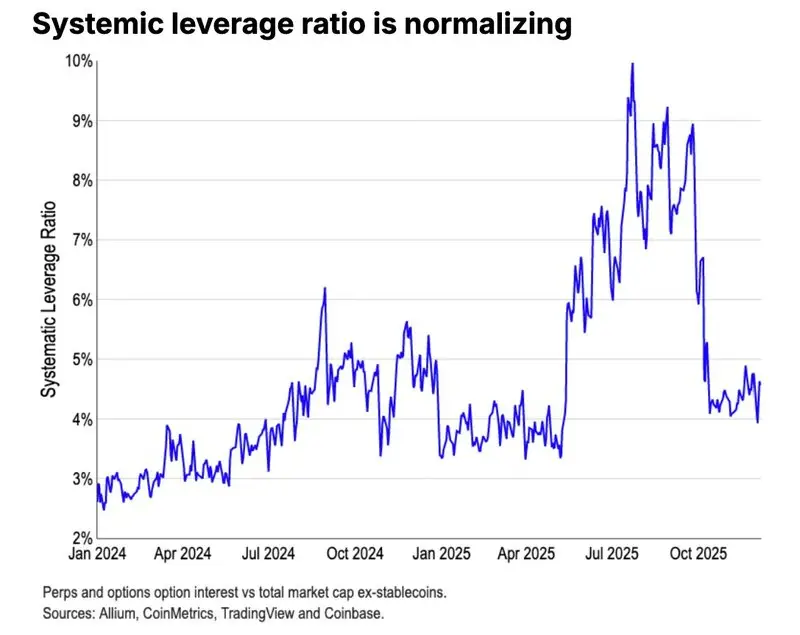

Our systemic leverage ratio, which tracks purely speculative positioning, has stabilized at ~4%–5% of total market cap, down from ~10% this summer.

Lower leverage = healthier market structure + less vulnerability to sharp drawdowns heading into year-end.”