Coinbase (COIN) is reportedly in advanced talks to purchase derivatives venue Deribit, a move that could shake up COIN’s stock future. Deribit is the world’s largest trading platform for Bitcoin and Ether options, and the acquisition would be huge for Coinbase, according to sources close to the deal.

These sources report that the companies have already notified regulators in Dubai about the discussions as Deribit holds a license there. Coinbase would officially take over this license upon the purchase, putting Coinbase in a strong position in that region. The leading US crypto exchange has already made several moves in the past week, including becoming Ethereum’s largest node operator. Indeed, the exchange officially operates 120,000 validators, controlling more than 11.4% of total staked Ethereum.

Coinbase (COIN) has become a clear favorite of the Trump administration as it returns to the White House this year. Although that push is certainly in its early stages, there is no shortage of potential. If the nation succeeds in becoming the “crypto capital of the world,” Coinbase could be among the biggest beneficiaries, making its stock a valuable investment option. COIN already has a revised $310 price target from Bernstein, but other analysts are even more bullish in the far term.

Also Read: Crypto Czar David Sacks Meets With UAE Officials to Talk Crypto, AI

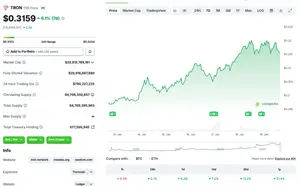

Analysts at CNN Business believe that Coinbase COIN stock has over 100% ROI potential from current prices. Out of 29 analysts surveyed by CNN, 41% suggest to buy COIN stock, while 52% suggest to hold as the price continues to rise. COIN is trading near the bottom of its 52-week range and below its 200-day simple moving average. Thus, some analysts suggest that it has bottomed out and only has room to rise from here. Following the potential purchase of Derbit, Coinbase stock could see a climb towards $311.00, a 64% ROI from current prices. However, that is just the median projection.

Indeed, if all continues to go Coinbase’s way, including more support from institutions and on a political level, COIN stock could surge as much as 150% from current prices in the next 12 months. A boom to $450 or even $500 per share would make COIN one of the biggest gainers in the next 365 days on the US stock market. Being the largest US-based crypto exchange, boasting a 66% market share and more than $400 billion in assets, nearing 10 million active users, all points towards a dominant future for Coinbase stock. Those numbers give it a headstart amid the ongoing Trump-led crypto push. Furthermore, analysts suggest the exchange is properly prepared to “ride the tailwinds” of the current administration, making now a huge investment opportunity.